Policy(Released on December 21, 2022)

Policy on Shareholder ReturnsBasic Policy for Enhancing Corporate Value

The Company's basic policy is to expand profits by promoting growth strategies and improve capital efficiency by reducing net assets, with the aim of enhancing corporate value that leads to increased profits for shareholders.

Promotion of Growth Strategies and Improvement of Capital Efficiency

Promotion of growth strategies

The Company has positioned the following as the axes of its growth strategy.

- Further improve fund performance through stronger investment management capabilities

- Increase fund size through stronger external fundraising capabilities in line with expansion of target markets

- Strengthen organizational foundation that supports the above activities

Improvement of capital efficiency

While gradually increasing the size of new funds in line with growth in target markets, the Company will aim to reduce its investment ratio in new funds from the current level of around 40% to 20% in 10 years. Accordingly, it plans to gradually reduce the necessary funds for business continuity (currently around ¥60 billion) in stages and consider shareholder returns of any excess funds.

By improving capital efficiency through the above measures, the Company will aim to increase the total return ratio, including the share buyback, to between 60% and over 100% and ROE to between 15% and 20%.

Policy on Shareholder Returns

The Company's basic dividend policy is to pay "the greater of 3% of shareholders' equity (average of beginning and end of period) or 50% of net income."

In addition to the above dividend policy, the Company will reduce the necessary funds for business continuity of around ¥60 billion (after deducting interest-bearing debts, accrued taxes, and expected dividend payments at the end of March of each fiscal year) in stages and allocate any excess funds for shareholder returns.

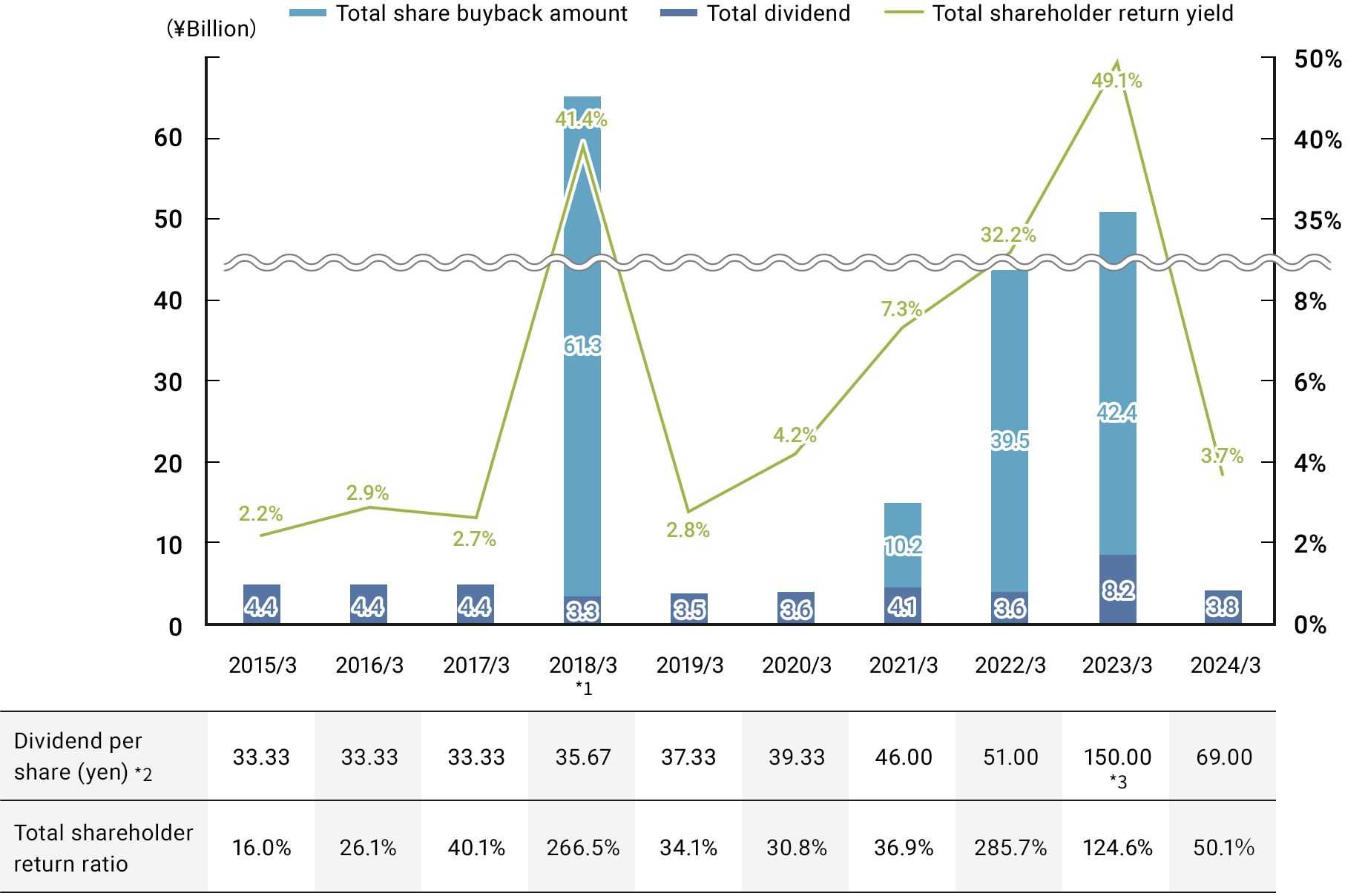

Status of Total Shareholder Return Yield

Dividends / share buybacks / total shareholder return yield / total shareholder return ratio

- *1

- 2018/3: Bought back all shares (27.8%) held by Nomura Holdings, Inc. and Nomura Research Institute, Ltd.

- *2

- Figures reflect a 3-for-1 stock split conducted in the fiscal year ended March 31, 2022

- *3

- The current dividend policy is as indicated in Policy on Shareholder Returns, in line with the review of the shareholder return policy announced in November 2022 (updated December the same year). However, for the fiscal year ended March 31, 2023 only, the dividend per share was the larger of the following:

- 150 yen; or

- The amount calculated by dividing the Company's net income attributable to JAFCO Group Co., Ltd. shareholders for the fiscal year ended March 31, 2023, including the gain on the sale of shares in Nomura Research Institute, Ltd. and after deducting the total acquisition price of shares bought back in the tender offer announced on December 21, 2022, by the number of Company shares outstanding on the record date of the dividend (excluding treasury shares then held by the Company)

- ・

- Total shareholder return yield= (Total dividend + Total share buyback amount) ÷ Term-end market capitalization (excluding treasury shares)

- ・

- Total shareholder return ratio= (Total dividend + Total share buyback amount) ÷ Net income

〔Status of share buybacks〕

- In the fiscal year ended March 31, 2018, the Company bought back all of its shares held by Nomura Holdings, Inc. and Nomura Research Institute, Ltd. (40,308,600 shares) and subsequently cancelled 47,233,008 treasury shares, including treasury shares previously held.

- In the fiscal year ended March 31, 2021, the Company bought back a total of 4,532,100 treasury shares by the end of March 2021 based on the resolution on share buyback passed in February 2021.

- In the fiscal year ended March 31, 2022, the Company bought back a total of 16,975,300 treasury shares by the end of March 2022 based on the resolutions on share buyback passed in February 2021 and October 2021.

- In the fiscal year ended March 31, 2023, the Company bought back a total of 202,200 treasury shares based on the resolution on share buyback passed in October 2021 and subsequently cancelled 7,630,000 treasury shares, including treasury shares previously held.

Also, the Company bought back a total of 16,800,000 treasury shares based on the resolution on tender offer of treasury shares and subsequently cancelled 17,220,000 treasury shares, including treasury shares previously held.

(The number of shares in 01 through 03 above reflects a 3-for-1 stock split conducted in the fiscal year ended March 31, 2022)