"IPO STORY" unravels the trajectory from the encounter between an entrepreneur and JAFCO to its listing. We will talk about episodes, thoughts, and future prospects of entrepreneurs who have successfully managed to get listed. This time, we will deliver a dialogue between Yoshihiro Maeda, President of Linkers Corporation, Ltd., which was listed on the Tokyo Stock Exchange Growth Market in October 2022, and Atsushi Fujii, a partner in charge of JAFCO.

【profile】

Linkers Corporation President and CEO Yoshihiro Maeda

After working for overseas sales at Kyocera Corporation for about 7 years, he was engaged in consulting for major domestic companies at Nomura Research Institute for about 7 years. Established the company in September 2011 with the aim of supporting recovery from the Great East Japan Earthquake and revitalizing Japanese industry, and assumed the position of Representative Director (current position). Graduated from the Faculty of Engineering, Osaka University in 2000.

[What's Linkers Corporation]

In order to create a new industrial structure that generates many innovations and maximize the productivity of the industry as a whole, we are developing services centered on business matching services that have strengths in "manufacturing". Currently, we are working on reforming the industrial structure with business matching as a keyword, such as expanding the introduction of the SaaS type business matching system mainly to regional financial institutions and introducing it to business companies. In October 2022, the IPO was completed on the Tokyo Stock Exchange Growth Market.

Starting from a 2 tatami office, growing into a listed company

Maeda It was 2013 when I first met Mr. Fujii. When considering fundraising, it all started when Mr. Minami, president of Visional, which was listed in 2021 as an investee of JAFCO, introduced me to Mr. Fujii. You came to the dilapidated office rented by Tameike Sanno...

The state of the office at that time

Fujii I was surprised to see you in an office the size of two tatami mats with no windows (laughs). I remember that at that time, we were just starting to receive several test orders for our current business matching service. It was impressive that President Maeda himself went to build the industry coordinator network that is the basis of the service.

Maeda The timing was right around the time when the business matching service's PoC (proof of concept) was successfully implemented several times. After raising funds, JAFCO introduced us to many major corporate customers, and thanks to that, we were able to launch our business. It was very reassuring to receive support from Mr. Fujii, who has a track record of investing in various growth companies, including Visional.

Fujii What do you think was the reason for the company's success in putting it on a growth trajectory?

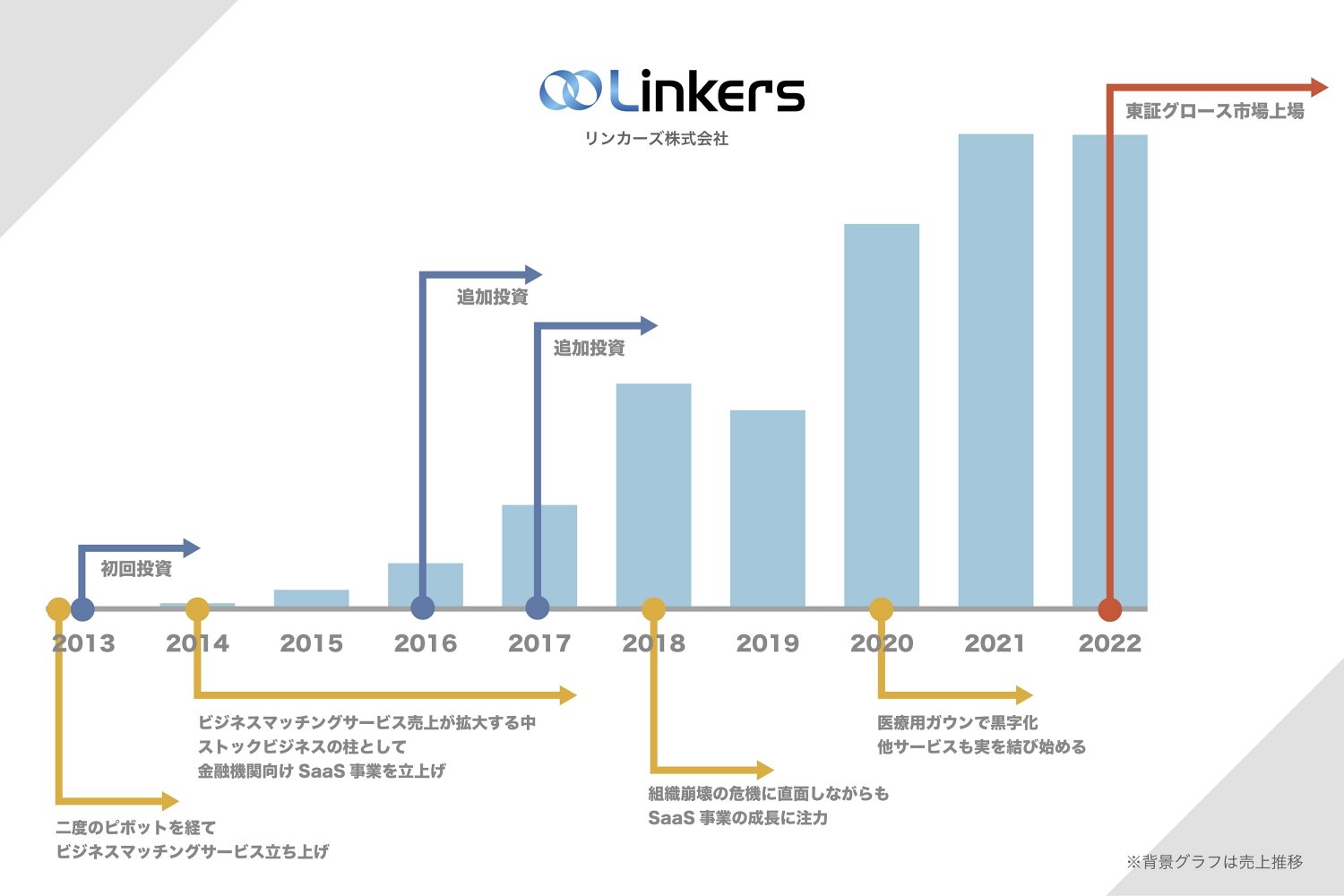

Maeda Looking back, I believe that launching a SaaS-type business matching system business for financial institutions in 2016, soon after the full-scale launch of the matching business in 2014, was successful. Because now this SaaS business has become one of the sources of stable stock earnings. It is expected that about 45 institutions, mainly financial institutions, will be introduced by the end of this fiscal year.

However, the theory of startups is to expand one business and then diversify it, so at that time I ran into various walls, and I was even scolded by Mr. Fujii.

Fujii At the time, you were working on various things other than SaaS, weren't you? If you start something new and then do something else, the employees will be exhausted, so I thought it was about time to start up in earnest, so I gave various advice on how to proceed with the business and management. rice field. However, with regard to SaaS for financial institutions, the president took the lead in launching it early, and his enthusiasm was different from other businesses, so I was impressed by its breakthrough power.

Maeda Entrepreneurs have a grand vision and run earnestly, so they tend to be lax when it comes to business expansion and organizational management. In that regard, I am keenly aware now that all the advice given by Mr. Fujii was correct. I have grown tremendously as a business owner.

Fujii The reason why the company was able to grow and go public was because of the power of the president and all of the employees. I may have taken some detours, but I think I was on the right track.

The presence of Mr. Egashira (Director and CFO of the Business Administration Division) was particularly important. You have become a key person in this listing. The president is like Messi, a soccer player who keeps attacking, and he might come up with the idea of increasing the number of goals to 2 or 3 in order to score. Mr. Egashira was the one who firmly determined that it was a violation of the rules and devoted himself to defense. He has a sense of respect for the president, but he can say what he has to say straight out, so I think we have a good chemistry.

After two pivots, Sannoya's business finally succeeded

Fujii The business has been pivoted several times before arriving at the concept of the current business matching service in 2013. Could you tell us about the difficulties you faced?

Maeda When I was working on the acquisition of solar power generation at Nomura Research Institute, I realized the difference in industrial structure between Japan and Europe and the United States. In Europe and the United States, where there is a job change society, human resources come and go from upstream to downstream in the value chain, so information is also circulated, and as a result, the business domain is optimized. On the other hand, Japan has a closed industrial structure compared to Europe and the United States. The structure makes it difficult for small and medium-sized companies with technological capabilities to seize business opportunities, making it difficult for innovation to occur and per capita GDP to continue to stagnate.

I want to visualize the technical information of Japanese companies and improve the productivity of the industry as a whole. I started a business with that thought, but it didn't go well. The first is an SNS for sharing and exchanging opinions on the value chain process. Next, a web exhibition system that allows small and medium-sized enterprises to publicize their technologies and products. However, many companies were reluctant to release their information to the outside, and both struggled.

Following the first arrow and second arrow, the third arrow was launched as a business matching service that connects major companies and technology partners. Traditionally, this area was handled by specialized trading companies. We succeeded in dramatically increasing the matching accuracy. Currently, it is a hybrid type with an AI-based search system to achieve even more accurate matching.

Loss of trust as president, risk of organizational collapse

Fujii Around 2017-2018, after launching the SaaS business for financial institutions, you faced a crisis of organizational collapse.

Maeda I focused too much on the SaaS business and lost the trust of the matching business employees. "The president doesn't look at the business," "I can't discuss it with you." More than half of the 70 people quit in half a year, and the business and organization were in trouble, but I still stuck to the SaaS launch. I thought that the only way to regain the lost trust was to produce results.

It took some time, but I think we were able to regain trust little by little by getting the SaaS business back on track. Also, when our business performance declined due to the corona crisis, we implemented about 20 measures, and the matching project for the production of medical gowns came to fruition, and it was a big factor that we were able to turn a profit. This has helped motivate our employees, and even after the special demand for medical gowns has ended, we have been able to secure profits from our existing business alone.

Fujii I think the hardest thing for the employees was not being able to trust the president. That's why I think that being able to succeed in the SaaS business and turn the medical gown project into the black brought great value to the organization.

Maeda Through that failure, I was keenly aware that without the organization and people, the vision cannot be realized. Now, I maintain close communication with each department manager and thoroughly maintain the motivation of the organization. If I had direct contact with the site, I would have to respond to each and every detailed request, and I would not be able to respond to the expansion of the organization. I believe that the key to growing a strong organization is for each general manager to communicate with members and take care of them in detail.

We usually communicate in this way, but I would like to see each employee more closely than before and deepen our relationship of trust. At the listing party the other day, I gave each and every employee a glass of wine with a personal message.

A society where SMEs with technological capabilities can compete globally

Fujii The company was listed on the stock exchange in October 2022, and entered the next stage. It was a bad time for the market, but I think it was extremely important that we were able to show our employees and shareholders that we were going to achieve what we set out to do. President, what are your thoughts on this timing?

Maeda I feel sorry for VCs who exit at this time, but considering the possibility that things will get worse in the future and the possibility that we will not be able to go public, it would be riskier not to go public at this time. I haven't been able to realize my vision yet, and I would like to reach at least the first stage within five years, so this listing is just a passing point. From now on, I think we need to concentrate more on our business than ever before.

Fujii What kind of things will you be working on after going public?

Maeda First, increase the number of financial institutions that introduce SaaS. In addition to banks, we are also promoting introduction to major insurance companies. We will maximize matching opportunities by strengthening "wide-area cooperation" that matches not only customers of our own bank but also customers of each financial institution. And eventually expand overseas. We already have a track record of matching between Japan and overseas in business matching services using industry coordinators and AI, so we would like to further accelerate this with SaaS.

Companies that are small in scale but have a very high market share in a specific field are called Hidden Champions, but there are only about 200 Hidden Champions in Japan, and about 1,200 in Germany.

Unlike Japan, which is an island country and closed in Japanese, Germany receives a large amount of information. Furthermore, unlike Japan, there is no culture where small and medium-sized companies are protected by affiliated companies, so it is natural for companies to manage PL by developing marketing and sales channels on their own. As a result, even small and medium-sized enterprises are expanding overseas. Germany's population is declining like Japan, but per capita GDP is expanding.

Our goal is to create hundreds of new Hidden champions in Japan. Through our matching, we will be able to see which companies will be able to generate more profits, so we will have those companies concentrate on technological development, and we will take charge of marketing and sales channel development and actively expand overseas. I'm going to sell it. We call it the "Super Japan" concept, and by doing so, we would like to create a system that will create many hidden champions like Germany, and contribute to the expansion of Japan's per capita GDP.

Fujii From my point of view, the president is an "indomitable manager" who uses hardships as fuel to move forward. Where does the president's driving force as an entrepreneur come from?

Maeda I think it's a sense of mission and an inferiority complex. When he was a university student, he read Kazuo Inamori's "Passion for Success" and was impressed, so he joined Kyocera to learn management philosophy. After joining Nomura Research Institute with the desire to "make a big impact on Japan," I became aware of the issues facing Japan's industrial structure, and came to a sense of mission that "I am the only one who can change the status quo." .

On the other hand, when I was a child, I was physically weak and grew up feeling inferior to my superior older brothers and friends. I believe that these two emotions are essential for human growth, so when hiring new members, whether or not they have them is an important factor in deciding.

Linkers Quality valued by all employees

Fujii President, what do you value as a manager?

Maeda Our company has a code of conduct called Linkers Quality, which not only our employees but also myself are always aware of. For example, "high-speed rotation of trial and error". Repeated failures are the shortcut to success, so we focus on how to speedily turn the PDCA cycle.

In order to maximize cost-effectiveness, the concept of "bottlenecks and key drivers" is important. Let's say that there is a course A that can climb Mt. Fuji in 5 hours and a course B that can climb in 3 hours but there is a possibility of brown bears. Most of us hesitate and choose course B, but I would like you to choose to spend an hour looking for an elevator that can be reached in 10 minutes. It is important to always think of ways to eliminate waste as much as possible and solve problems with less effort.

If you misunderstand the problem, the solution will also be wrong, so it is also important to identify the problem from multiple angles and "get the facts." In addition, in order to continue to provide value to society, it is necessary for not only our customers but also our startups to earn profits and realize a "three-way win". I would like to embody these Linkers Quality throughout the company and strive to realize our vision.

Fujii As an investor, I am very happy to be able to see the process of the listing and growth of Linkers, which I have worked with since the days of the 2 tatami office, and it is also a support for my work. I hope that you will make great strides toward becoming a company that has a major impact on the economy of Japan and the rest of the world.

Mr. Maeda and Atsushi Fujii capitalist in charge of JAFCO (left)