"IPO STORY" unravels the trajectory from the encounter between an entrepreneur and JAFCO to its listing. We will talk about episodes, thoughts, and future prospects of entrepreneurs who have successfully managed to get listed. This time, we will deliver a dialogue between Mr. Tsuyoshi Yoshino, President and CEO of Microwave Chemical Co., Ltd., which was listed on the Tokyo Stock Exchange Growth Market in June 2022, and Mizuki Takahara, a partner in charge of JAFCO.

【Profile】

Microwave Chemical Co., Ltd. President & CEO Iwao Yoshino

After leaving Mitsui & Co., Ltd. (Chemicals Division), engaged in venture and consulting in the United States. In August 2007, he established Microwave Chemical Co., Ltd. and assumed the position of Representative Director (current position). Graduated from Keio University Faculty of Law in 1990, and received an MBA from UC Berkeley in 2002. A Hitachi Fellow in Management of Technology (MOT).

[What's Microwave Chemical Co., Ltd.]

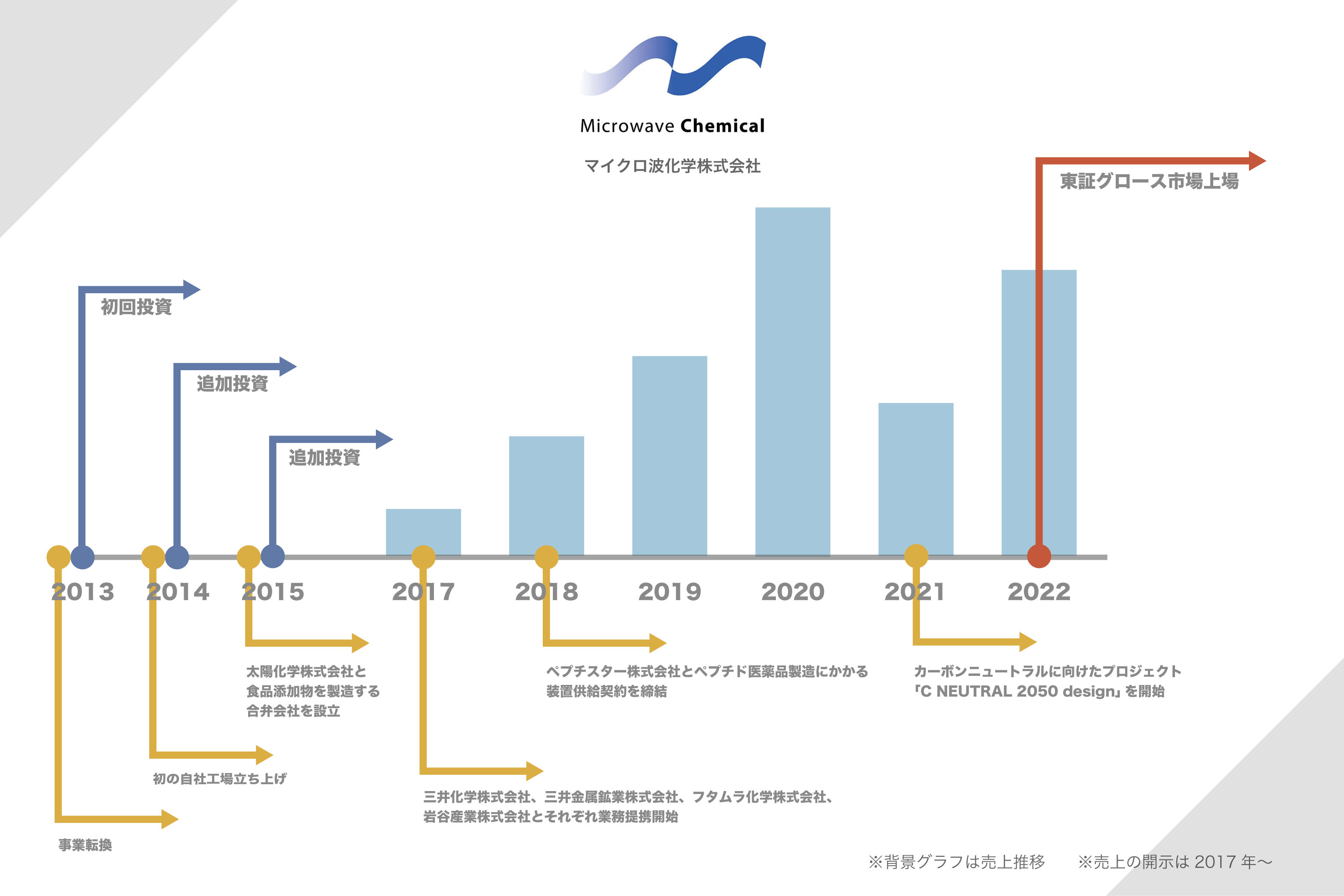

The company continued to work on the commercialization of the microwave process, which was said to be difficult to industrialize, and established a microwave technology platform. Currently, it is collaborating with companies and institutions in Japan and overseas to build and provide total solutions from research and development to engineering. Due to the recent trend toward carbon neutrality, it is being deployed in various fields as a key technology for industrial process electrification. In June 2022, it mad IPO on the Tokyo Stock Exchange Growth Market.

15 years since founding. We are here today because we have steadily accumulated technology

Yoshino Mr. Takahara took charge of our company in 2020, the year when the coronavirus began to spread. As a handover from the predecessor.

Takahara Yes. JAFCO made its first investment in 2013, and by the time I took over, the business had started and preparations for listing were in full swing.

Yoshino Of course, it was our first IPO, so it was really helpful to have Mr. Takahara, who has a lot of experience, on our side. He participated in board meetings as an observer, and if there was anything I didn't understand, I called and consulted with him, saying, ``I was told this by a securities company, but what was their intention?'', among other things.

Takahara I am relieved to hear that. (laughs). When I took over, the business had already been established, so I was constantly thinking about how I could contribute to Microwave Chemistry from a different perspective than my predecessor. It was not easy to come up with a strategy for an IPO because it is a business category that requires ingenuity to understand, as it uses microwaves to change the manufacturing processes of the chemical industry, which has continued for 100 years.

Since you founded the company as a start-up from Osaka University in 2007, you had been working on a so-called deep tech business, and you went public 15 years later. Looking back, do you feel that it took a long time?

Yoshino It was a long time coming. I thought I knew that startups were a series of hypothesis testing, but I expected results to come out sooner.

At first, we started out as a manufacturer and seller of biodiesel and ink made from waste oil using microwaves, but I struggled to make a profit. From that experience, we arrived at the current business model of providing the platform technology itself for manufacturing using microwaves, rather than selling products.

Takahara In terms of the turning point in the business, was it the time when you shifted to the current business model?

Yoshino That's right. In shifting our business model, the first thing we decided to do was to build our own factory. We tried to embody how manufacturing using microwaves could lead to energy saving and high efficiency. Despite being told that it would be impossible for a start-up to set up a factory, we received an investment from a VC who appreciated the future potential of our business, and in 2014 completed the world's first large-scale microwave chemical factory.

After that, we worked on "joint venture manufacturing business" such as establishing a joint venture company to manufacture food additives with Taiyo Kagaku, and gradually accumulated a track record of commercial production with chemical manufacturers, which gradually increased the number of inquiries. The supply of peptide pharmaceutical manufacturing equipment to PeptiStar in 2019 was also a major turning point, and we were able to establish a business that we wanted to focus on the most: providing technology for manufacturing processes and equipment using microwaves.

In the chemical industry, which emphasizes safety and security, it is extremely difficult to get people to adopt our unprecedented technology. In the beginning, there was a time when fees were several tens of thousands of yen per day, but I believe that the fact that we are now generating revenues in the hundreds of millions of yen is the result of steady accumulation of technology.

Overcame many adversities before achieving IPO

Takahara How did you feel when you became profitable for the first time in the fiscal year ended March 31, 2020?

Yoshino I thought, "We've finally come this far,'' but in terms of the company's ability, there was a strong feeling that "there's still a long way to go." In the meantime, Corona started to expand. Since it was a business model that relied on customers' capital investment, the degree of impact on our business was great.

Takahara In response to the corona, it became necessary to make a major review of the business growth strategy, including the timing of the IPO.

Yoshino We were hit hard by the changes in the business environment caused by the coronavirus. However, I believe that it was precisely because of that difficult period that we were able to transform the business into something more grounded. We have established businesses such as chemical recycling that take risks and standardize technology, and have expanded our organization considerably. Various players such as in business development, research, engineers, public relations, etc. have increased, and it is now possible to make realistic calculations that "if we take this kind of measure, this will happen in years later."

Takahara I think that the strategy and atmosphere of the management team when the head wind is blowing is easy to come out "genuine", but I was very impressed by Mr. Yoshino's always poised and positive atmosphere. On the other hand, you are very calm, saying things like, ``Now let's raise funds with bank loans to increase our cash position,'' or ``Let's temporarily stop the investments we had planned for this year, and create firm financial discipline.'' You were thinking about countermeasures. Looking back on that time, I realize that the ingenuity and ideas that can only be born in the midst of adversity have led to your current growth.

Changes in the environment had a big impact on the listing this time, too.

Yoshino The market began to deteriorate after we decided to make an IPO around November 2021, but on the day of the information meeting to make a presentation to investors, the invasion of Ukraine began. Sure enough, the market got even worse. We see IPOs as a waypoint for growth, so in response to this drastic change in the environment, management debated whether or not we should do an IPO now.

The management team agreed that "We don't know what the situation will be one year from now. If there is a chance, we should do an IPO,"but we also decided to ask the opinion of our major shareholder JAFCO. When I consulted Mr. Takahara, he said, "You should do it. When thinking about the future of Microwave Chemistry, even in this kind of environment, an IPO should lead to medium- to long-term growth." With that advice, I was able to make up my mind.

Management and organizational issues unique to university startups

Takahara What I really wanted to ask you today is about the difficulty of running a university-launched startup. Co-founder Mr. Tsukahara (director and CSO of Microwave Chemistry / at the time of establishment: specially appointed associate professor at the Graduate School of Osaka University) is in the position of academia, but I was wondering how Mr. Yoshino felt about founding and running a business together with a university professor.

Yoshino In the past, I have tried to launch technology startups several times without success, but the challenges were always the same. I was trying to work with engineers who had a low priority on commercializing technology and putting it out into the world. In that respect, Tsukahara was very ambitious for the commercialization of microwaves. Also, we made a promise when I started the company. Conflicts can inevitably arise when you hold two positions as an academia and a company manager, so when the time comes when if you have to choose between the two, I would like you to choose the company.

Takahara I see. Looking at the two of you, I didn't feel the contrast between the teacher and the president at all, but there was such a firm promise.

Yoshino Also, I think we're maintaining a reasonable sense of distance. We used to go out drinking together, but we never met on weekends. However, since we communicate well on a daily basis, there is almost no deviation in the direction of management and business.

Takahara Does that mean you have not had many organizational difficulties?

Yoshino That's not true. We have quite a lot of people who have changed jobs from major companies, and many of those who have worked at major companies are good at backcasting, thinking about what they should do now by working backwards from their goals. But in a startup with high uncertainty, you have to leave ambiguity without backcasting too much. As the company matures, it will become necessary to think backcasting, but at this stage it is easy for mismatches to occur. Also important is whether or not you can tolerate failure. A startup cannot move forward unless it fails.

Takahara Mr. Yoshino's high degree of tolerance is something I've seen many times overcoming severe negotiations (laughs). University-launched startups often struggle to expand their sales channels. How was that?

Yoshino In that regard, the VCs really helped. Both VCs, who joined us in the early stages of our founding, and JAFCO, who joined us from Series B, have many routes to the top layers of major companies that could become our customers, so they kindly cooperated with us.

Contribute to carbon neutrality by commercializing microwaves

Takahara I learned a lot from watching Mr. Yoshino working on the IPO, and I'm really glad that we were able to achieve IPO this time. Of course, listing is not the end, but " just the beginning". What are your future goals?

Yoshino All I can say is that I want to grow my business. Of the industry-wide CO 2 emissions, the chemical industry accounts for about 17%. If we combine microwaves with renewable energy to innovate the manufacturing process, this leads to a significant reduction in CO2. The vision of having a positive impact on social issues cannot be realized by a small business. Currently, the number of inquiries is increasing significantly in the midst of the big trend of carbon neutrality, and we will continue to expand our business by focusing on expanding our demonstration factory and improving efficiency.

Tsukahara often says, "Chemistry is suitable for Japanese people." Inspiration is necessary, but in the field of chemistry, the more you accumulate things over time, the more results you will get. He thinks the reason why there are so many Japanese winners of the Nobel Prize in Chemistry is because they are a good match for each other. Thanks to our 15 years of accumulated technology, we have finally reached a phase where our value is recognized. After going through the IPO, I am bracing myself for "just the beginning".

Takahara The keywords such as Carbon Neutral and SDGs have become popular in the past few years, but Mr. Yoshino noticed a big trend long before that and seized the opportunity at an early stage. I feel that this perspective and attitude is one of Yoshino's strengths as an entrepreneur.

Yoshino When I was at Mitsui & Co., Ltd., I remember my boss telling me this. ``Money-making is severe. People pay you only when they recognize the value of your hard work, so business is very pure." This is the starting point of my commitment to contributing to the environment through business.

Global climate change is irreversible and something must be done. We will create a profitable system as a business, not as an NPO or NGO, and work hard and sincerely to create value. Customers who recognize the value of our business will pay for it, allowing us to continue and expand our business and increase our influence on society. As an entrepreneur, it would be my greatest pleasure to contribute to environmental and energy issues as a result of such a cycle.

Mr. Yoshino and JAFCO capitalist Mizuki Takahara (left)