The AI market has been expanding rapidly in recent years with cutting-edge technologies such as ChatGPT. AVILEN, Inc., founded in 2018, is one of the companies that has achieved remarkable growth in the AI solution business by leveraging its advanced technology. Through strategic capital/business alliances with various leading Japanese companies, AVILEN is poised for discontinuous innovation, not settling for the status quo.

We sat down with Representative Director Kotaro Takahashi, Executive Officer and COO Ryo Matsukura, and Director and CFO Takuo Nishiki, to discuss their business and growth strategies, as well as hearing the perspectives of JAFCO's investment professional in charge of AVILEN, Yusuke Yanagidate.

【Profile】

Kotaro Takahashi, Representative Director, AVILEN, Inc.

Graduated from University of Tokyo graduate school. Engaged in research on instantaneous tsunami height prediction using machine learning. He joined AVILEN as a founding member and has been the Representative Director since 2021. He manages the company to deliver the latest technology to as many people as possible and has achieved high growth through such means as strategic partnerships with seven large companies. He is a member of the standardization committee of the Association for Promotion of Financial Data Utilization.

Ryo Matsukura, Executive Officer and COO, AVILEN, Inc.

Graduated from the University of Tokyo and the Wharton School of Business at the University of Pennsylvania, majoring in business analytics and finance.

After working for the Ministry of Economy, Trade and Industry as well as Bain & Company, he worked as a consultant and lawyer, assisting major companies in creating new businesses, developing strategies for startups, and providing DX support to local governments. He is a member of the web3PT working group of the LDP's Headquarters for the Promotion of a Digital Society as well as a DX advisor to Kyoto City.

Takuo Nishiki, Director and CFO, AVILEN, Inc.

Graduated from Waseda University graduate school. He has about 10 years of experience in investment banking and is well versed in M&A and overall financial strategies. Before joining AVILEN, he worked at a listed company as the manager of the corporate planning division, where he gained experience in capital/business alliances, IR, and other operations. At AVILEN, he is responsible for finance, accounting, general affairs, and human resources, as well as for IPO preparation, alliances with major companies, and executing capital/business alliances and strategic partnerships with seven listed companies, including Japan Post Group and Otsuka Corporation.

【About AVILEN, Inc.】

Since its establishment in 2018, AVILEN has been developing and implementing AI software using AVILEN AI, its proprietary core technology module, under a vision of bringing the latest technology to as many people as possible, and also provided AI-driven build-up packages to more than 530 companies, including those that had not been certified as "DX-Ready" companies. In April 2023, it started expanding sales of ChatMee Pro, a SaaS product that combines the core module Instructea with Chat GPT, and began full-scale expansion into the generative AI business.

Achieving 150% increase in client numbers by utilizing cutting-edge technologies like ChatGPT

The AI market is attracting worldwide attention with technologies such as ChatGPT. Please tell us about the AI solutions business that AVILEN is involved in.

Takahashi: First, we provide AI software. AI is used in a variety of ways and, although they may appear different, there are technical commonalities. In the recent trend of image generation AI, the automatic generation of product package designs and the generation of avatars from photographs of people utilize similar technologies. We have made these commonalities into core technology modules, which we customize and provide according to the client's issues.

In addition, we provide SaaS as packaged software using core technology modules developed in-house. Among our SaaS offerings, we are particularly focusing on ChatMee Pro, a SaaS that utilizes ChatGPT, which mainly refers to information on the Web when generating text. ChatMee Pro is a service that combines ChatGPT and our core technology module Instructea in a secure environment developed by AVILEN to improve the efficiency of internal information organization, business writing, process management, etc., based on individual information of the client company.

While these AI software products can significantly increase an organization's productivity, simply introducing them is not enough to make them practical for organizations that lack AI personnel. This is where our other service, the Build-Up Package (*), comes into play. We provide organizational development and AI human resource training for client companies. We transform our clients' business models in a comprehensive manner, from the creation of a foundation to utilize AI in the organization to the actual implementation of solutions through software. That is our AI solution business.

*Build-Up Package: A packaged service based on organizational assessment and roadmap formulation, e-learning to support organizational development through cross-departmental AI human resource development for managers, employees, management planning, engineers, etc.

Kotaro Takahashi, Representative Director

What kind of projects have you worked on so far?

Takahashi: The following are a few examples:

Real Estate Industry

Background: There were issues with the number of real estate appraisers who could evaluate appropriate land prices and the scale of their processing capacity.

We developed software that can analyze images, official land price listings, and transaction cases, which are the basis for real estate appraisals, and perform the work of real estate appraisers. The software not only solves manpower shortages, but also expands the processing capacity of real estate appraisals and unearths potential markets.

Consulting Industry

Background: In the M&A matching business, the creation of a long list of buyer companies was time-consuming and the accuracy varied from consultant to consultant.

We developed a system that generates a long list of buying companies by entering seller company information, and contributed to a significant improvement in operational efficiency and matching accuracy.

Medical Industry

Background: Tests to see distribution of cells for disease detection were performed manually, and the number of tests performed was limited.

We developed software that determines diseases by collecting data on cells and examining their distribution through data clustering and abnormality detection, creating a system that enables efficient and highly accurate examinations.

In this way, we have been involved in business transformation for a wide variety of companies, regardless of industry.

Nishiki In the five years since our founding in 2018, we have done business with more than 530 companies. It is rare for an AI vendor to work with so many customers. In terms of the results for the fiscal year ended December 2022, the number of companies we have done business with rose by 50% from the previous year, and the business retention rate is 82%. This is due to our ability to reach out to a large number of customers through our own media, which are highly recognized in the AI field, as well as our high technological capabilities covering everything from organizational development to software provision, which makes it easier for us to expand business to other departments of a client once the initial deal has been made.

Takuo Nishiki, Director and CFO

Takuo Nishiki, Director and CFO

The AI market is expanding rapidly, but are there any challenges?

Takahashi: As of 2023, the DX business market in Japan amounts to 2.1 trillion yen (*1). Of this, the AI business market accounts for approximately 1.4 trillion yen (*2). It is estimated that by 2030 the DX business market and AI business market will expand to 5.2 trillion yen and 2.6 trillion yen, respectively, making them extremely promising markets. However, in Japan, where the population is declining, AI adoption is often hindered by a lack of human resources and literacy within companies, and labor productivity is stagnant, ranking 27th (*3) out of 38 OECD member countries. While the market is expanding, the gap between supply and demand is widening.

When AI does the work that humans don't have to do, we can focus on more creative work. AI could bring out more of human creativity. This would make the world a more convenient and affluent place, enhancing customer experience. We aim to create a society in which humans can maximize their creativity through our AI solution business, which includes the provision of software that utilizes cutting-edge AI technology.

*1: "Digital Transformation (DX) Domestic Market (Investment Amount) Survey" (2023) by Fuji Chimera Research Institute, Inc.

*2: "Artificial Intelligence Business Survey" (2022) by Fuji Chimera Research Institute, Inc.

*3: "International Comparison of Labor Productivity 2022" (2022) by Japan Productivity Center

What is the reason why you have been able to maintain high technological capabilities in the ever-evolving AI field?

Takahashi: The large-scale language model used in ChatGPT, for example, is being updated on a daily basis, with new papers being published every day. We have established an in-house process to constantly catch up with these changes, which enables us to utilize them in our projects and improve the modules in real time.

Another key point is our unique machine learning researcher community, DS-Hub. The community is made up of researchers from various universities, including the University of Tokyo, who have passed a screening test which has a pass rate of below 6%. Members are encouraged to participate in our company's projects. Through a unique system where talented people attract talented people, as of December 2022, we have 197 data scientists and engineers, 22 of whom have become our full-time employees. Our ability to secure a stable supply of excellent AI personnel is also linked to our ability to maintain high technological capabilities.

Strategic capital/business alliances with seven companies, including the largest investment in recent years from a major corporation

From left, AVILEN COO Matsukura, Director Okawa, Representative Director Takahashi, JAFCO Yanagidate, CFO Nishiki, Executive Officer Ota

We would now like to ask you about the strategic capital/business alliances that AVILEN is currently pursuing as a strategy to accelerate its growth. First of all, please tell us about your business situation in recent years.

Takahashi While most AI vendors' revenue growth rate is around 30%, our company's revenue growth rate was 53.3% for the fiscal year ending December 2022. Excluding irregularities due to changes in fiscal periods, we have remained profitable in real terms since our founding, and our gross profit margin and operating profit margin are among the highest in the industry. We have achieved high profit margins for a number of reasons, including the high efficiency of customized software development I mentioned earlier and our ability to secure excellent human resources through the DS-Hub without incurring recruitment costs.

Please give us an overview of the strategic capital/business alliances and how you chose this means of cooperation.

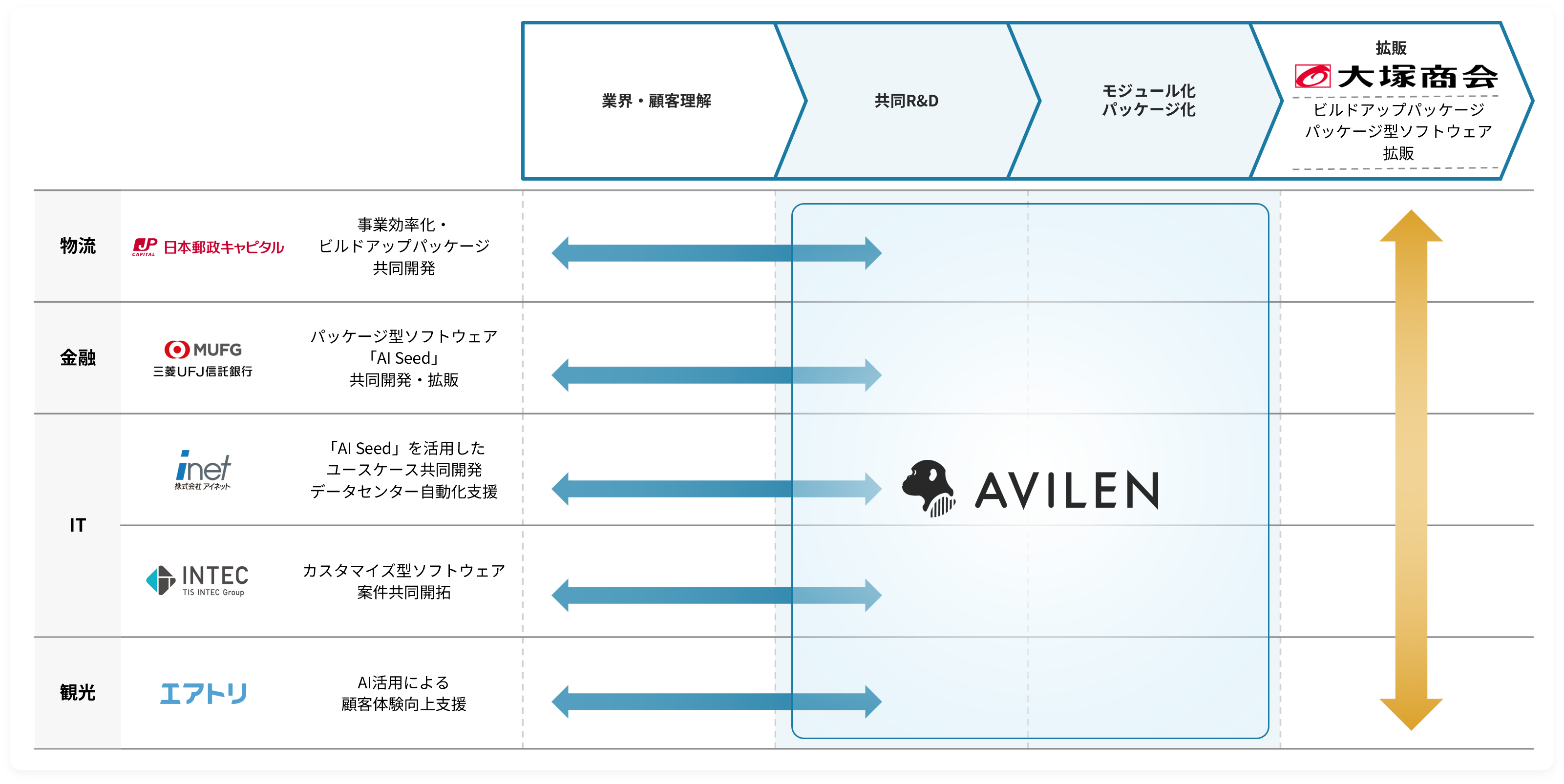

Matsukura We entered into our first capital/business alliance in March 2022 and, as of July 2023, we have partnered with a total of seven companies. In addition to business companies in various industries such as logistics, finance, IT, and tourism, we have also had institutional investors join us. While maximizing the strengths of each company, we intend to strengthen the joint development of solutions for the issues faced by the industry as a whole and the expansion of their sales (horizontal development).

Matsukura We believe that we should focus on our core competence of solving business problems of many customers with a deeper understanding of their business challenges based on our core technological capabilities. To achieve this, we need strong partners who can work with us to develop and expand sales. By building medium- to long-term relationships through not only business alliances, but also capital alliances, together we will lead the coming age of AI while enhancing the corporate value of both parties. With this in mind, we have chosen to form strategic capital/business alliances.

Ryo Matsukura, Executive Officer and COO

Nishiki We carefully judged the companies we would potentially partner with based on whether or not it would be a beneficial alliance that leads to mutual growth, taking into consideration the industry and functions of each. In addition, it was important for us to increase the ratio of stable shareholders with a view to shareholder composition and share price formation after going public.

We were very grateful to receive many inquiries, and some of them were even from individual executives who wanted to invest in the company, but in many cases we had to decline due to time constraints and the purpose of the alliances. We are now moving toward an IPO, and we intend to continue to actively utilize these strategic capital/business alliances even after we go public.

What kind of synergies have you started to create with other companies?

Matsukura We have formed a capital/business alliance with Japan Post Capital to support the DX promotion of the entire Japan Post Group. The Japan Post Group has a very wide range of businesses, not only limited to finance, insurance, and logistics, and has accumulated a vast amount of knowledge and data over its long history. The alliance has allowed us to capture their true AI issues and incorporate them into our solutions. It is a very good arrangement, and each party involved feels that a track record has been developed. This has led to a large increase in their investment ratio.

Nishiki With Otsuka Corporation, which has strengths in sales that transcend industry boundaries, we will strengthen our collaboration in all areas related to the promotion of AI solutions for all of Otsuka Corporation's business partners, centered on expanding sales of ChatMee Pro. In fact, we initially began discussions on a smaller capital/business alliance before full-scale negotiations, but they were impressed by our growth potential and ended up making a 19% investment in us as an important partner indispensable to their future growth strategy. We felt that this was a sign of their expectations for our growth and their seriousness about ChatMee Pro, and it was a sobering experience for us. In the field of AI, we have realized that synergies with major companies in the industry can be drawn from multiple angles and lead to tangible results, which leads to the accelerated growth of startups.

JAFCO has invested in AVILEN since 2020, leveraging its management know-how and unique network of over 30,000 companies to create synergies and help AVILEN further accelerate its growth. How did you work with JAFCO in the strategic capital/business alliance?

Nishiki: JAFCO, which had already taken a stake in our company, agreed to transfer its shares to our partner company out of respect for our growth strategy. Since we started forming strategic capital/business alliances in 2022, the results of business synergies with each company have been reflected in concrete figures. I believe that JAFCO will come to appreciate the future potential of our company, which is expected to increase further as we move forward with capital/business alliances.

Yanagidate AVILEN had mapped out this path as a strategy to accelerate its growth, so JAFCO had a strong desire to be in the same boat. While it is common for a company to conduct M&A as a buyer, it is not so easy for a startup to do so in terms of financial and human resources. In the case of AVILEN, it's the opposite. AVILEN first receives the investment from the partner company-to-be before both parties start promoting the improvement of corporate value. Moreover, AVILEN's operating cash flow has always been in the black and there was no demand for funds, so the entire investment was made not through private placement of new shares, but through a transfer of existing shares, which I believe is a unique approach. Japan Post Capital, which AVILEN partnered with in 2022, increased its stake by an additional 20%, which is a testament to the synergies achieved within one year after the initial investment. This experience must have given the AVILEN management team a great deal of confidence.

Yusuke Yanagidate, JAFCO Investment Specialist

Next goal: IPO and M&A strategy as further growth engine

What are your plans for the future and after the IPO?

Nishiki The purpose of our IPO is to ensure strategic and continuous M&A activities in the future. We are already actively sourcing M&A deals on a daily basis, and we intend to accelerate this movement with an eye toward discontinuous innovation. In this round, Japan Investment Advisor Group has also invested in our company, and we have formed a strategic partnership with a view to eventually forming joint ventures and acquisitions.

Matsukura There are many companies that could increase their value with the power of AI and digitalization, but are not able to do so, or are not utilizing their valuable data. The bottleneck for such companies is a lack of AI human resources and knowledge. We can directly increase the value of such companies through our M&A activities. I believe that this will lead to the realization of a "society in which humans can maximize their creativity," as Mr. Takahashi mentioned at the beginning.

We would like to actively utilize M&A as a further growth engine following our continuous growth from inception to date and discontinuous innovation through strategic capital and business alliances.

Yanagidate I have had the opportunity to speak with many companies when pursuing capital/business alliances, and I have often heard people say, frankly, "When a company like AVILEN grows, society becomes a better place." As an investor, I am happy to see AVILEN functioning as a core part of a larger social structure accelerating its growth, and to be involved in the activities of such a company.

Comment from Investment Specialist Yusuke Yanagidate

AVILEN's strengths are its technological capability to incorporate a wide range of the latest technologies, its product management capability and speed to commercialize these technologies as a package. It is also a company that is growing by turning the chronic social challenge of a shortage of AI human resources into its strength. Through strategic capital/business alliances with companies active on the front lines of their respective industries, it has achieved discontinuous innovation that a startup alone could not achieve. It correctly understands the value chain and positions itself to create higher added value within it. Furthermore, it forms partnerships with top runners in each industry to maximize the benefits for society as a whole. AVILEN has been able to achieve such a formation because of the personality of Representative Director Kotaro and the teamwork of the experienced executive team, which has attracted many supporters. Please keep an eye on the company's remarkable progress going forward.

AVILEN's strengths are its technological capability to incorporate a wide range of the latest technologies, its product management capability and speed to commercialize these technologies as a package. It is also a company that is growing by turning the chronic social challenge of a shortage of AI human resources into its strength. Through strategic capital/business alliances with companies active on the front lines of their respective industries, it has achieved discontinuous innovation that a startup alone could not achieve. It correctly understands the value chain and positions itself to create higher added value within it. Furthermore, it forms partnerships with top runners in each industry to maximize the benefits for society as a whole. AVILEN has been able to achieve such a formation because of the personality of Representative Director Kotaro and the teamwork of the experienced executive team, which has attracted many supporters. Please keep an eye on the company's remarkable progress going forward.