The JAFCO Group invests not only in Japan, but also in rapidly growing Asia and North America, which leads cutting-edge technology.

In Asia, in particular, growth is remarkable in Indonesia and Vietnam, as well as in the Greater China region including Taiwan, which is the world's second largest economy, and India, where population growth and economic growth are accelerating. Recently, the number of start-ups achieving global growth, like SHEIN, Appier, and AnyMind in which JAFCO Asia has invested, is increasing, and the market will increase its importance even more in the world.

This time, Naohiro Furuya and Kent Horio, who are the Business Development ("BD") Division members in charge of BD activities for Asian portfolio companies and who work together with investment teams to implement various initiatives, talk about the specific functions and approach of their roles in JAFCO Asia, which plays an important part of our global investment.

【Profile】

Naohiro Furuya, Business Development Division Principal in charge of the Asian region, JAFCO Group Co., Ltd.

Joined JAFCO in 1991. Between 1991-1996, he worked in the Investment Division of the Fukuoka Branch (later merged into West Japan Branch). Between 1996-2002, he was seconded to the Investment Division of PNB-NJI Holdings (JV with Malaysian government-affiliated financial institution). There, he invested in distributed computing (currently SaaS, PaaS, IaaS) and other IT services, which were in their infancy. Since 2002, he has consistently engaged in BD activities for Asian portfolio companies. He has achieved numerous exits by working closely with venture capitalists and founders on growth, funding, recruitment, and other strategies for portfolio companies in China, India, and Taiwan. He graduated from the Faculty of Economics, Rikkyo University.

Kent Horio , Senior Associate of the Business Development Division in charge of the Asia region, JAFCO Group Co., Ltd.

Joined JAFCO Group in 2022, providing support for startups in the Asia ex. Japan portfolio. Before JAFCO, he was at a travel tech startup as the country head of a subsidiary and led business development engagements (including product development, sales, M&A/JV set up). Prior to that, Kent was in the Tokyo office of a leading management consulting firm where he was responsible for projects related to strategy, operation, risk and M&A, mainly in the financial services, healthcare and retail sectors. He graduated from the Department of Economics from the University of Warwick.

The rapidly growing Asian market is a lifeline for Japan

─Please tell us why you are focusing on the Asian region among the rest of the world.

Furuya Even on a global scale, Asia now accounts for nearly 40% of the world economy, and is expected to account for 60% by 2030*.

Geographically Japan is part of Asia. JAFCO Asia focuses on VC investment in Asia, which it positions as the most important, inseparable market from the perspective of Japan, where the birthrate is declining and the population is aging.

─Next, please tell us about JAFCO Asia, which is making global investments.

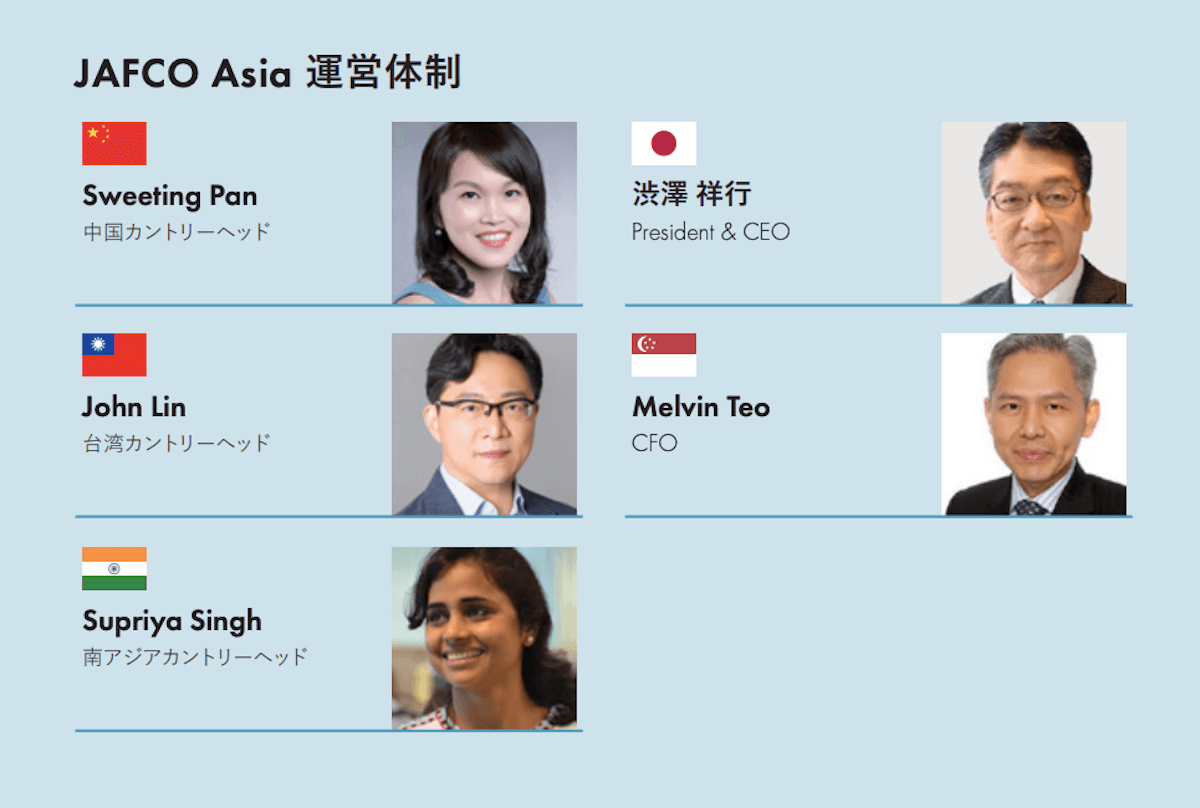

Furuya JAFCO Asia has gone beyond the stage of "Japanese VC expansion in Asia," and, as an Asian venture capital with strong connections to Japan, we are working to enhance the value of our portfolio companies by making investment decisions unique to each region and providing hands-on support to founders.

(Source: JAFCO Group "Integrated Report Fiscal Year Ending March 2022")

Our expansion into the Asian region dates back to the early 1990s. After the Asian currency crisis, we made a fresh start in 2000 under a new management structure. Since then, we have made various improvements, and since 2012, the current CEO, Mr. Shibusawa (in Singapore) has taken a leadership in evolving the company into its current form. To date, we have established 10 Asia-dedicated funds with a cumulative total of 1.3 billion US dollars, invested in 300 companies, of which more than 200 have made exits including 50 IPOs.

─Which countries in Asia are you focusing on the most?

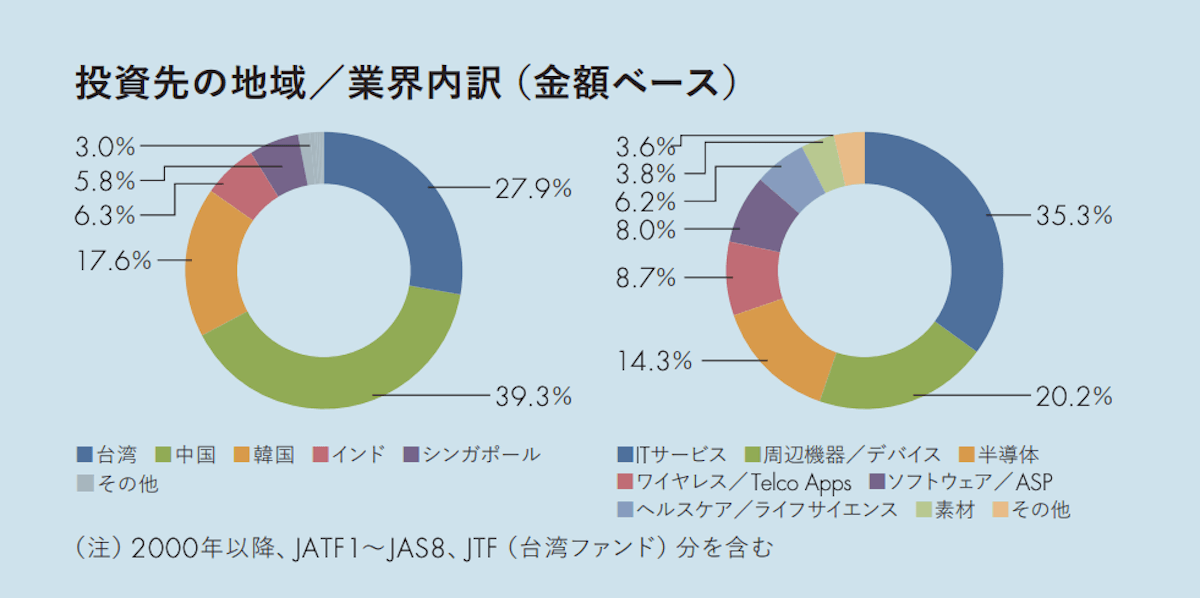

Furuya Greater China (China and Taiwan) accounts for about 60% of the current investment amount.

(Source: JAFCO Group "Integrated Report Fiscal Year Ending March 2022")

(Source: JAFCO Group "Integrated Report Fiscal Year Ending March 2022")

In recent years, as is well known, China has formed a sophisticated ecosystem, even from a global perspective, in the IT, digital, electronics and other domains, and the VC/PE market has expanded to a scale far exceeding that of Japan. While Taiwan has produced some of the world's leading companies in the fields of semiconductors and contract manufacturing/processing, many manufacturing-related companies (areas with high business potential with major Japanese companies) are still being born. In addition, due to the recent geopolitical risks, many new types of network security startups have emerged.

It is not easy for a foreign VC firm to take root in the huge and fiercely competitive Chinese market, but one of JAFCO Asia's unique characteristics is that it continues to establish its presence in the Greater China region. In fact, returns from investments in China and Taiwan have contributed greatly to the performance of the funds managed by JAFCO Asia.

─In addition to the Greater China region, what other countries have you invested in?

Furuya We also target India, which has a population of 1.4 billion and is expected to become the third largest GDP country in the world, and Southeast Asia, which is developing in its own unique way. In the region, the growth of GDP per capita and the expansion of the middle-income class are providing tailwinds for the emergence of unique startups. The growth in this region cannot be overlooked. On the other hand, although Asian countries are connected, the reality is that they are not "one country called Asia." Therefore, in addition to China and Taiwan, JAFCO Asia's main targets also include India, Singapore, Vietnam, and Indonesia.

Fall in love with portfolio companies and remain committed with the mindset of a co-founder

─Next, please tell us about the business development initiatives that support the value enhancement of portfolio companies.

Horio The Business Development Division (hereinafter referred to as BD), to which we belong, is working on two vectors: "Japan Entry," the aim of which is to enter the Japanese market by working together with local venture capitalists, and "Asia (China) Entry," the aim of which is to work with fund investors and other major Japanese business corporations in Japan to enter Chinese and other Asian markets.

Furuya A specific example is the case of AnyMind Group, which was listed on the Tokyo Stock Exchange Growth Market on March 29, 2023.

AnyMind was founded in Singapore in 2016 by Mr. Kosuke Sogo (CEO), and has provided its clients with influencer marketing in Asian countries and advertising on premium local media specific to each region on such a scale that even major advertising agencies in Japan have not been able to achieve.

Currently, Anymind has come to provide a one-stop platform to support all aspects of commerce in D2C, from product development to the selection of production contractors, e-commerce construction, inventory and logistics management, and marketing. Through the acquisition of 7 companies so far, Anymind, in its 6th year of establishment, has more than 1,200 staff in 13 offices in 11 countries, including India and the Middle East, literally embodying global expansion since its establishment.

In order to develop and propose marketing strategies in the Southeast Asian region for major domestic clients, JAFCO Asia has identified more than 30 potential customers for Anymind. In addition, we led planning of pre-listing funding strategies, supported fundraising up to the Series D round totaling 112 million USD, supported negotiations/ DD/ background checks for acquisitions, and worked with the BD team in Japan (support for establishing back-office system) to prepare for listing, including tax inversions. We have worked on all fronts by combining assets of the JAFCO Group.

Furuya At Appier, which promotes marketing automation and DX using AI, we have developed sales to about 120 to 130 companies in cooperation with the sales team of its Japanese subsidiary.

Originally, Appier had no actual business presence in Japan, but we were convinced of its future potential as a cutting-edge AI-based technology company from Asia, since it was made up of a group of experts and scientists who had written teaching materials for students studying AI at top U.S. universities such as Harvard and Stanford.

In fact, when we made our first investment in 2015, we targeted game developers in Japan through proposal-based sales aimed at promoting the installation of smartphone apps and improving CPI (Cost Per Integration). As a result, sales to companies referred by JAFCO Group accounted for about half of Appier's total sales.

─ So you provide the necessary support each time after ascertaining the timing and phase.

Furuya As you said, the Asia BD team's policy is to work closely with the local investment team and the entrepreneurs/management teams of portfolio companies in Asia to seriously tackle the management issues of startups that change drastically day and night.

To overcome challenges regardless of time differences, day or night, our company smartphones have messenger apps tailored to each country, such as LINE, Kakao Talk, WeChat, WhatsApp, and Messenger. In the management of a startup, it is unpredictable when and how issues will arise, so, although we are in charge of BD support, we expect to have the same sense of urgency as local venture capitalists who are the first to be consulted on "first call" in such an emergency situation.

To be honest, when a portfolio company in Asia establishes a local subsidiary outside its own country, it is not easy to understand the business customs, culture, and national character of the country into which it is advancing. Therefore, until the system in Japan is established, we, the JAFCO Asia BD team, are committed to developing businesses in Japan for the portfolio company from a "Japanese" perspective. This activity requires a certain amount of skill.

The Asian BD operation is very exciting as it involves building mutual trust with the founders of portfolio companies, large global companies, and multi-national team members of JAFCO Asia across the sea and borders and putting into practice business development strategies on a global scale. At the same time, it is by no means an easy mission. In addition to a flexible approach and a high level of creativity, it is necessary to have high aspirations.

─Please tell us about how the BD team works with portfolio companies in various cooperative initiatives.

Furuya We have traditionally focused on market development for portfolio companies, but in addition to this kind of direct sales support, we are expanding the breadth and depth of our involvement to include business strategy development (feasibility studies), recruitment, and matching/negotiations with business partners and investors. Our mission is the same as that of "a deputy country head," like the branch manager of a Japanese subsidiary at the time of launch.

Hence, although I am not actually neither, I sometimes I give advice to "reconsider" the Japan entry. From the perspective of an Asian portfolio company, the Japanese market is the third largest in the world, or a "life in pink." However, entering an overseas market requires a lot of funds and company resources, and above all, it takes time, including PMF verification. Challenges come with failure. You can't grow if you're always afraid. At the same time, there is a high degree of tension in the sense that careless mistakes are not permitted in making critical management decisions that are difficult to backtrack.

Is it really necessary to enter the Japanese market now? Is it possible to cover the costs of entering the Japanese market with profits from existing businesses? Is there a possibility to win in the Japanese market? Will cash on hand and funding be sufficient? Why not make a small start based on an alliance strategy? If you misjudge the timing of expansion, you may miss growth opportunities or suffer great losses. A half-hearted strategy that overestimates the risks can produce meaningless results that are worse than doing nothing. I would like to be involved to make proposals as to the optimal entry timing and method that would enhance the value of the portfolio companies based on repeated verification and discussions in a proper and speedy manner.

Horio For this reason, the Asia BD team consciously thinks through the "falling in love with the company" part, which goes one step beyond the basic premise of understanding portfolio companies.

For example, there is the AI voice assistant service for the hospitality industry called Aiello provided by our portfolio company in Taiwan, which I am in charge. When I touched the demo for the first time, I felt that the quality stood out compared to other services. At that moment, I thought, "This is amazing," and felt that I wanted to spread it more and more.

Aiello, in particular, seems to be one or two steps ahead of the rest of the world, as it has incorporated the much-talked-about Chat GPT into its service immediately after the release. There are many similar excellent startups in Asia, so we try to understand the companies we invest in by studying the latest technology trends, and work to improve their value as if we had fallen in love with them.

Make people want to entrust the Japanese market entry to JAFCO. Same passion and vision as an entrepreneur

─Finally, what are your future goals and challenges for the JAFCO Asia BD team?

Furuya It is a premise and a goal to have a strong sense of ownership, or a mindset of co-founder, regardless of the type of business or industry of our portfolio companies, and to always be a fellow worker of the portfolio company. I strongly hope to demonstrate our position as "the go-to company when it comes to Japan" and " JAFCO, when it comes to Japan market entry."

Also, regarding entry into Asia, one of our major goals going forward is to create impactful businesses together with business companies that invest in our funds.

Horio I think we need to further strengthen our network in Japan. In the future, I would like to contribute to the expansion of Japanese companies into Asia.

Furuya Utilizing the JAFCO Group's network of large companies and the wealth of accumulated case studies and know-how, we wish to keep contributing to corporate value enhancement for our portfolio companies by being a good companion and partner for founders and entrepreneurs who are active on a global scale.

Note: Asian Development Bank, Asian Development Outlook (ADO) 2017: Transcending the Middle-Income Challenge, 2017