"Actual scenes" in business that changes rapidly.

It can be seen everywhere inside and outside the organization, from visible "stock price" and "sales", "reaction" on the Internet to "atmosphere" among members. In particular, the world situation has changed tremendously since the 2020s, and we are stepping into a chaotic world where no one has the correct answer.

JAFCO Group has consistently made investments even in the midst of these changes. In this issue, Naoki Sato, Corporate Officer in charge of the Business Development Division, will talk about JAFCO's efforts to support portfolio companies, and talk about the specific details of support and how to deal with portfolio companies.

【profile】

Joined the company in 1992. Since then, he has consistently engaged in investment exit activities on the front lines, and has been involved in a wide variety of projects, from startup investments to buyout-type investments. After being appointed as a partner in 2018, he supervised the portfolio companies' value-up specialist team and brushed up JAFCO's status as a venture capital. In June 2022, he was appointed Corporate Officer in charge of Business Development.

[Main achievements of business development support]

■ Marketing and sales support

ー Business matching 644 cases

- Lead acquisition seminars with portfolio companies: 79 with a total of about 9,300 participants

■ HR support

ーRecruitment decision 77 people

■ Back office support

- Listing preparation consulting: 24 companies

*Results for 2021

The JAFCO Group has continued to face investment without being constrained by changes

The trigger was the Lehman shock. VC's standing position will change greatly

―First, please tell us about the JAFCO Group's thoughts on the role of venture capital (hereafter, VC) in the modern world.

Sato to put it simply, I believe that the role of modern VCs is to "provide the resources of 'people, goods, and money' for the growth of investee companies and increase the speed and angle of growth."

In the early days, we mainly invested in middle-stage companies with a certain level of earnings base and later-stage companies nearing IPO. At that time, the role of VC support was to "consider IPO preparations together", such as reorganizing the shareholder composition, improving the financial structure, and supporting capital tie-ups.

However, the focus of investment has gradually shifted to the seed and early stage, and along with that, the role of VCs and the nature of their support have changed.

―What were the factors behind the shift in the focus of investment from middle-later to seed-early?

Sato There is a trend that the way of investment in the United States began to be incorporated into Japan from the mid-1990s, but the biggest change was the Lehman shock.

JAFCO also recorded a large loss due to the Lehman shock. While reviewing the investment strategy and the way VCs should be, we have narrowed down our investments based on the belief that it is essential to face the business together with entrepreneurs from the seed and early stages in order to generate capital gains without being influenced by the market environment. As a result, we shifted to "highly selective, intensive investment" that focuses on large-scale investments and hands-on management support to increase the angle of growth.

From diversified investment to highly selective, intensive investment. Strengthening relationships with portfolio companies

―What specific changes have you made as a result of shifting from diversified investment to carefully selected, concentrated investment?

Sato Of course, the number of portfolio companies that are highly valued in the IPO market has increased, but the relationship value between a capitalist and a portfolio company has clearly changed as the number of portfolio companies that a single capitalist takes charge has been narrowed down.

Specifically, capitalists and JAFCO's portfolio company support team work together to provide support to address corporate and management issues raised during dialogue with management. There are also capitalists who work at portfolio companies for a certain period of time on an as needed basis, so the "concentration level" of involvement is definitely increasing.

We have evolved the way we invest with the times, but what underlies our investment is "respect for entrepreneurs". The entire work force, including capitalists, portfolio company support teams, and members of the corporate service department who are not directly involved with portfolio companies, has shared the same perspective. I think this is the culture of JAFCO that has remained unchanged since its founding in 1973.

JAFCO's focus on "portfolio company support"

Support centering on three functions according to the situation of portfolio companies

―Please tell us more about JAFCO's portfolio company support.

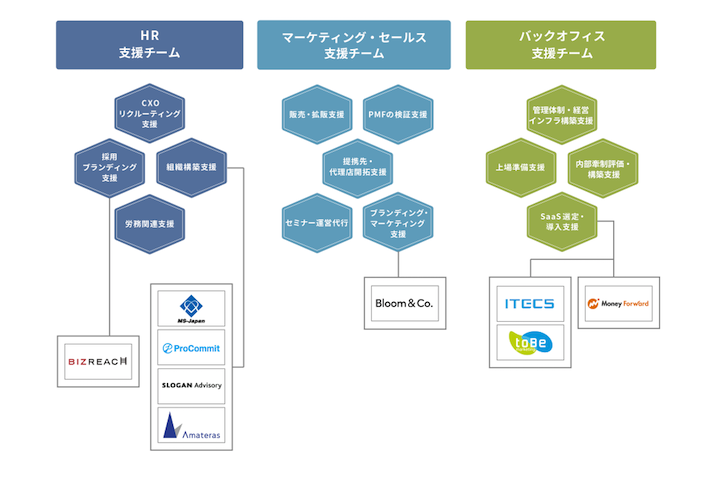

Sato Currently, we provide support centered on three functions: "marketing/sales support," "HR support," and "back office support."

We have been working in the marketing/sales and back-office fields for about 20 years, making use of the network with large companies created from JAFCO's past achievements and the knowledge we have cultivated while working on IPO support.

After that, when the target of investment changed to seed and early stage companies, we thought that we should strengthen the function of "recruiting human resources", which is the key to growth in venture companies in the founding stage. We have also strengthened support in the HR area, including organizational construction.

In addition, we have partnered with Bloom & Co. to provide marketing and branding support. We provide opportunities for portfolio companies to bounce ideas with Bloom & Co. and a place to answer questions, such as "how should the company's strategy and image be presented?," "how much shall be spent on branding measures?", etc. arising from dialogue, and solve issues through advice from professional point of view. We have provided support to more than 30 companies.

JAFCO Group's Company-wide Support for Portfolio Companies

―When thinking about the specific content of support, please tell us about how JAFCO aims to interact with investee companies.

Sato At Startup, there are not enough resources to launch a business in the shortest possible time. That's why, in addition to the three core functions, we also provide support in areas such as public relations and corporate if we think it is necessary to launch a business.

In the past, we have received consultations about "what kind of system should be built?"

―It seems that there is something in common with your stance of "thinking about what kind of support you can provide rather than defining your role."

Sato That's right. If JAFCO's experience can be used in investee companies, we will provide it.If we do not have the necessary resources to support business launches, we will naturally cooperate with external parties.

After all, everything is "on-site feeling". I think that's all there is to say. Therefore, we do not have thoughts such as "this should be" or "this is the only thing we can do", but have respect for entrepreneurs and work together with them to meet their needs. I believe that this is what makes JAFCO unique.

"Respect for entrepreneurs" that we have maintained since our founding

Start from scratch

―I think there are many situations in the business creation phase where the "correct answer" is not known. How do you consider this point when providing support and consulting?

Sato Basically, I think that the "premise" is that we don't know the correct answer. There are countless management options, and especially in the seed and early stages, there is no telling whether the product will be accepted by the world or whether the business will take off.

That is why I believe that it is important for entrepreneurs and capitalists to carry out measures with a sense of mutual understanding based on that premise.

―What happens when there is a difference of opinion between the entrepreneur and the capitalist...?

Sato Of course, there are many such scenes. In order to create a sense of satisfaction in such a situation, it is essential to have a one-on-one dialogue with the entrepreneur to face the issue.

First of all, go back to the origin, where is the goal you are aiming for. On top of that, we tell them about the challenges seen from the capitalists' point of view and give proposals. I think it is desirable to make decisions based on the information acquired by listening carefully to the ideas of entrepreneurs and managers and saying what we should say to each other. I believe the basis of judgement lies in whether the promised business plan is on track, and if there is a discrepancy, we should correct the course.

What does JAFCO think about in the true sense of "portfolio company support"?

-thank you. Lastly, do you have a message for entrepreneurs who are trying new businesses?

Sato A variety of things can happen to startups. Under such circumstances, JAFCO has thought through "what is necessary" and consistently supported entrepreneurs, and as a result, built a system that allows it to commit to the growth of portfolio companies.

I hope that entrepreneurs who create new businesses and open up the future will utilize JAFCO as a "companion" and a "CO-FOUNDER," who aims to improve corporate value and create businesses together based on "respect for entrepreneurs.".