Venture Investment

What we value most is standing with entrepreneurs and walking alongside them through both good times and bad. As the "closest partner" of our portfolio companies, we aim to continue delivering meaningful value that propels their growth, flexibly adjusting to shifting landscapes.

With over 50 years of domestic investment experience, we have in place a system that allows us to work closely with a wide range of entrepreneurs.

By also pursuing investments scheme beyond conventional frameworks, we are committed to supporting the growth of businesses that will shape the future.

With over 50 years of domestic investment experience, we have in place a system that allows us to work closely with a wide range of entrepreneurs.

By also pursuing investments scheme beyond conventional frameworks, we are committed to supporting the growth of businesses that will shape the future.

Investments to date

4,241

Total IPOs

1,041

Cumulative figures for domestic and foreign venture and buyout portfolio companies (as of December 31, 2025). Investments and IPOs by funds managed by transferred former Asian subsidiaries in and after November 2025 and by the transferred former US subsidiary in and after January 2026 are excluded.

Characteristics of Our Venture Investment

We engage with entrepreneurs from the earliest stages, investing in

pre-founding, seed, and early-stage startups and playing an active

role in subsequent financing. With continued funding and provision

of management resources, we remain deeply involved in supporting

their growth.

Bold investment in young startups backed by many years of experience

We primarily invest in entrepreneurs before or shortly after founding their businesses as well as seed and early-stage companies.

With investments to pre-founding and beginning-stage ventures ranging from several hundred million to over a billion yen, we contribute to new businesses by providing the capital that forms the foundation for rapid growth and engaging deeply in management to help create new possibilities.

Development stage of startups at initial investment

Development stage ratio of portfolio companies under the SV7 Fund as of the initial investment (ratio by the number of portfolio companies; invested in 60 companies as of March, 31, 2025)

Investment per Startup

*Average for VC industry is based on the section “Average Investment Amount per Deal by Portfolio Company Stage (Domestic), 2023” in Venture Enterprise Center, Japan’s Venture White Paper 2024 *JAFCO’s amount of initial investment is based on investments made during the fiscal year ended March 31, 2025.

Playing an active role in financing and providing ongoing funding to support rapid growth

As the initial lead investor, we take the initiative to support large funding rounds after our initial investment.

With additional investments made as needed to support business growth, we flexibly and continuously support our portfolio companies throughout their journey.

Ratio of deals where we acted as lead investor

86.1 %

Ratio of companies we invested in multiple times

67.6 %

*The ratio of deals where we acted as lead investor is based on initial investments made in the SV6 Fund’s 72 venture portfolio companies (as of the end of December 2024).

The ratio of companies we invested in multiple times is the ratio of portfolio companies under the SV6 Fund in which we made two or more investments (as of the end of March 2024).

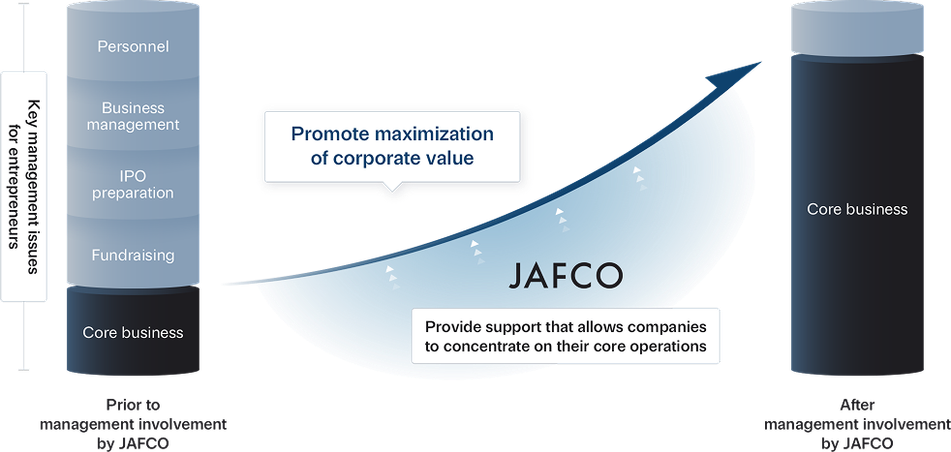

Proactive management involvement to deliver businesses to the world more quickly and widely

According to the business domain, structures, challenges, and growth stages of portfolio companies, we assemble a support unit with optimal members.

In addition to proactively engaging in management decisions and business development as an investor, we support startups whose organizational structures may not yet be solid to be able to focus on their core business, aiming to maximize corporate value.

We have a highly specialized business development team that works alongside our investment professionals. In order to accelerate the growth of our portfolio companies, we actively engage in key areas and aim for shared success.

Business Development Track Record

Number of contacts with business firms

5,000+

*Number of JAFCO's unique contacts calculated from our in-house CRM tool, Salesforce, as of March 31, 2025.

Number of companies supported in

organizational and recruitment matters

126

*Number of JAFCO's portfolio companies supported in solving the issues about Organization and Human Resource from April 2018 to March 2025.

Number of companies supported in back-

office structuring and IPO preparation

70

*Number of JAFCO's portfolio companies supported in solving BO structuring and IPO preparation issues from January 2020 to March 2025.

More about business development

Business Development

Case Studies

Visional, Inc

-

Established

-

2007 (As the predecessor company)

-

Line of business

-

Creating a Human Capital Management Ecosystem through our solutions such as “BizReach” a job change site that connects professionals to companies, “Internal BizReach by HRMOS” that prevents the outflow of human resources through internal scouting activities, and “HRMOS” series, a human capital management cloud, as well as promoting industrial DX through business development in M&A, logistics Tech, and cybersecurity domains.

Initial investment

2010

IPO

Apr. 22, 2021

After the global financial crisis and market downturn, JAFCO executed an initial investment of ¥0.2 billion in Visional. We supported the company from the very early stage, when the management team was working out of a single apartment to launch the business. JAFCO was deeply involved, including co-founding a new company together with the team.

Money Forward, Inc.

-

Established

-

2012

-

Line of business

-

Provider of "Money Forward" personal asset management/ accounting service and "MF Cloud Accounting/ Finance/ Payroll" cloud services for small and midsize companies

Initial investment

2013

IPO

Sep. 29, 2017

JAFCO invested in Money Forward for the customer value its product delivers, the advanced technology behind it, and the company's dedicated founding team comprised of highly capable and principled individuals. We actively provided the funding and resources needed to support the business’s rapid growth and played a central role in arranging financing from financial institutions and forming business alliances to enable its expansion.

dely Inc.

-

Established

-

2014

-

Line of business

-

A video recipe service

Initial investment

2017

IPO

Dec. 19, 2024

In an industry saturated with similar services domestically and abroad, dely was showing signs of rapid growth even while still in the PMF stage. JAFCO executed investments to help accelerate the growth of dely's recipe video business. Since then, as an early-stage key shareholder, JAFCO accompanied dely on its journey all the way to its IPO more than ten years after its founding.

Synspective Inc.

-

Established

-

2018

-

Line of business

-

Development and manufacture of small SAR satellites and satellite data solution provider service

Initial investment

2018

IPO

Dec. 19, 2024

JAFCO supported Synspective’s IPO with an initial investment just two months after the company’s founding, followed by multiple additional investments that helped it go public within seven years. Our support also catalyzed the world’s fastest early-stage fundraising for a space-related startup and guided subsequent financing totaling ¥36.5 billion.

Timee, Inc.

-

Established

-

2017

-

Line of business

-

Operation of a matching service for spare time jobs

Initial investment

2019

IPO

Jul. 26, 2024

JAFCO supported a young entrepreneur dedicated to realizing new workstyles and transforming lifestyles and society, as well as a service and team with the potential to address pressing social challenges, as the lead investor. We continued to be deeply involved in key management decisions all the way through to its IPO, which achieved a market cap exceeding ¥100 billion.

Contact Us

We value every initial meeting with entrepreneurs who have a vision for new businesses, and we welcome inquiries from those seeking funding or preparing to launch.

Contact Form

.jpg)