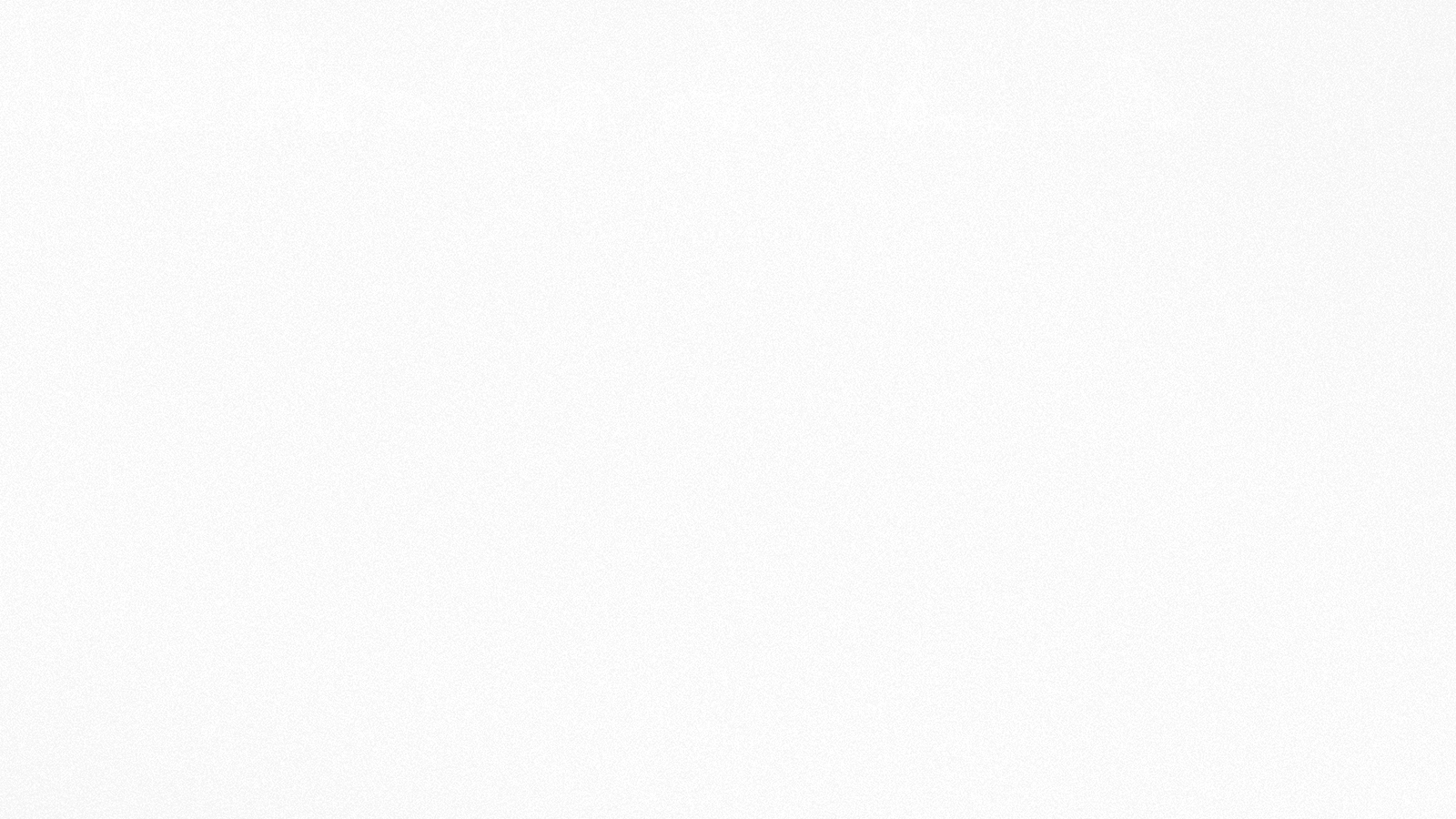

Value Creation Process and Material Issues

Value Creation Process

We will contribute to the sustainable growth of society by continuously investing in the new challenges taken on by entrepreneurs and corporations and by driving the revitalization of industries.

-

Cumulative number

of portfolio

companies -

4,245

-

Total funds under

management -

¥4,584 billion

(Capital

commitments)

-

Financial indicators

-

Net sales

¥29.7 billion

-

Ordinary loss

¥13.2 billion

-

Profit attributable to JAFCO Group Co.,

Ltd. stockholders¥9.6 billion

*Note: All figures are for the fiscal year ended March 31, 2025.

Zoom in

Material Issues

Materiality concerns are important medium- to long-term issues that must be addressed to enhance corporate value and realize our Purpose: “Fueling perpetual growth; investing in bold visions.”

Private equity investment, and venture investment in particular, have a direct impact on the resolution of social issues. For this reason, since our founding 50 years ago, we have focused on private equity investment based on our investment philosophy of continuing to invest through good times and bad. Our belief that we can address social issues and enhance prosperity by maintaining investment activities, creating new businesses, and supporting the growth of companies, has remained unchanged since our founding.

It is also important that we grasp changes in the external environment and reflect them in management. We will do so by considering the perspectives of various stakeholders and continuing to engage them in dialogue to accurately ascertain social demand.

Based on this unwavering belief and our flexible management approach, we will maintain efforts to identify and resolve materiality in order to enhance corporate value and realize our Purpose.

-

Creation of new businesses that lead the way in fulfilling social needs

Innovation is essential for the sustainable development of society and economic growth.

We will accelerate the creation of new businesses by increasing the number of entrepreneurs while capturing actual and future social demand. -

Growth of companies with social value and succession to the next generation

Amid a lack of successors, ongoing technological innovation and diversifying competition, the environment around companies is becoming increasingly complex.

We will enhance companies’ capacity for renewed growth and continue to protect employment by passing on high-potential technologies and assets to the next generation to maintain and increase their social value. -

Expansion of risk capital supply in Japan

Creating new industries and enhancing companies’ capacity for renewed growth are vital to Japan’s medium- to long-term growth, and risk capital is essential for supporting these efforts.

As Japan continues to lack a sufficient supply of risk capital, we are committed to expanding the number of both domestic and foreign fund providers in Japan’s private equity market. -

Establishment of an ecosystem that supports business creation and growth

Creating new businesses and reinvigorating corporate growth require a structure supported not only by specific companies but also wider society.

We will establish an ecosystem in which professionals with expertise can work together to create a framework for supporting enterprising personnel and form networks for boosting corporate growth. -

Continuous organizational development to promote active roles of diverse human resources

A combination of diverse perspectives and wide-ranging strengths is essential for the sustainable development of society.

We will create an environment in which diverse personnel can work together and continue to play active roles, regardless of their age, gender, or nationality, to boost the creativity of society as a whole. -

Reduction of business and management risks through strengthening of governance

As social issues become more complex, stakeholder expectations and the need for corporate responsibility will increase.

In this environment, we will contribute to a sustainable society by strengthening governance and actively promoting sustainability initiatives.

The materiality identification process is available here

Integrated Report 2023

Environment