Purpose

Fueling perpetual growth; investing in bold visions

With years of investment experience, we have consistently invested in the new challenges of companies and entrepreneurs, based on our conviction that continued investment helps create a sustainable society. As issues surrounding the global environment and the global economy become increasingly complex, we will create a cycle of new growth and contribute to the realization of a sustainable society by making bold investments in challenges that create new value and committing ourselves to their growth.

See our corporate philosophy

Business Model

Business Model

JAFCO engages in venture investment and buyout investment through fund management. We invest in unlisted securities by channeling capital gathered from investors into funds. Based on our policy of highly selective, intensive investment, we aim to improve investment performance (MOIC*) by continuously seeking out and investing in promising companies. After investment, we enhance management involvement and increase the corporate value of our portfolio companies to achieve exits (sales) through IPOs or trade sales such as M&A.

Our three main sources of income are management fees and success fees derived from fund operations and capital gains on direct investment in funds. We aim to maximize profits by expanding our fund size in line with the market and achieving high MOIC.

*MOIC (multiple on invested capital) : Revenue from operational investment securities ÷ Cost of operational investment securities

Our Three Sources of Income

Our three sources of income are fund management fees earned as fees relative to the capital commitments made by our limited partners into our funds, success fees earned on the funds’ returns, and capital gains derived as returns from our own investments in the funds.

We will work to increase MOIC (investment management capabilities) and funding from our limited partners (fundraising capabilities), which are the key drivers for sustainably increasing our income.

Our Two Business Domains

Our two business domains are venture investment, which is our founding business, and buyout investment, our second pillar.

By holding asset classes with differing characteristics, we can mitigate the impact of market influences and promote operational stability.

Going forward, we will focus on maximizing the potential of both venture investment and buyout investment and combining their respective strengths, while also establishing a unique organizational foundation with the aim of achieving an even greater level of performance.

See investment performance

Business Process

Our basic business process starts with fund formation. Fundraising for our domestic flagship funds is led by the Fund Management Division, which collaborates with the Investment Division and Business Development Division to engage with potential corporate investors.

We assemble teams that are optimal to each investment—primarily with our Investment Division and Structured Investment Division—and provide comprehensive growth support from the deal-sourcing stage to exit.

Depending on the company’s growth stage, these dedicated teams support recruitment, marketing, sales, back office formation, and IPO preparation to enhance the corporate value of portfolio companies.

Fund Formation

Establishing funds that are attractive to investors as financial products

-

Funds are formed about once every three and a half years at an appropriate size given market conditions

-

Promoting the expansion of the risk capital market by strengthening relationships with existing investors and developing new investor segments

Fund Management

Fund

Manage-

ment

We uphold our principles, ensure transparent management, and respond to the needs of our limited partners in order to establish robust trust-based relationships.

Learn more

Venture

Investment

With a highly selective, intensive investment approach, we primarily target promising seed and early-stage startups and actively engage in their management.

Learn more

Identifying investments

Investment decision and execution

Portfolio company support

Exit

Buyout

Investment

In addition to traditional buyout investments, we conduct “venture buyouts,” proactively supporting the growth of portfolio companies.

Learn more

Sourcing

Execution

PMI

Exit

Business

Development

Active support in enhancing corporate value drawing on specialized expertise according to the growth stage of the portfolio company

-

Recruitment

and organization

building -

Marketing

and sales -

Back-office

developement

Learn more

JAFCO's Strengths

Our Three Sources of Value

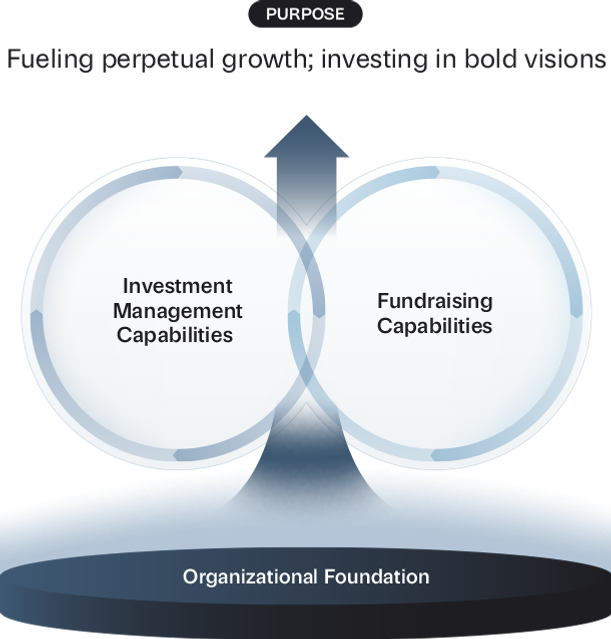

JAFCO's strengths lie in its investment management and fundraising capabilities, as well as in the organizational foundation that supports these activities.

Our two key drivers of profit growth are our ability to achieve a high level of performance by identifying investment opportunities and contributing to corporate growth, and our ability to raise funds from external sources by building relationships of trust with our investors and attracting new ones.

Investment management capabilities and fundraising capabilities mutually influence one another, so it is important to continuously improve both capabilities in line with market expansion.

Underpinning these two key drivers is our robust organizational foundation. Establishing and passing on systems and culture as an organization, rather than relying on specific individuals, makes it possible to improve our ability to reproduce successes.

By leveraging these three strengths as sources of value, we are generating stable earnings and fueling perpetual growth.

Investment Management Capabilities

We promote highly selective, intensive investment while continuously refining both our organizational ability to share, gather, and complement the experience of individuals and the ability of our investment professionals to contribute to the growth of portfolio companies.

Fundraising Capabilities

In fundraising and fund management, we will work to enhance our regular reports and offer support tailored to the individual needs of investors. By continuously raising our level of discipline and transparency, we will deepen our relationships of trust with existing investors while working to attract new ones.

Organizational Foundation

Our strengths lie in our unique model for recruiting and training new graduates to become investment professionals and in our culture of passing on know-how. In addition, with our dedicated divisions for supporting portfolio companies and managing funds, as well as our robust compliance and risk management system, we contribute to reproducing successful performance.

JAFCO in Numbers

Investment Management Capabilities

New contacts made by our investment professionals in FY March 2025 (domestic)

3,855 COS

Cumulative number of portfolio companies

4,221 COS

Total IPOs

1,039 COS

Average exit multiple over the past 5 years (domestic)

2.6 X

*As of March 31, 2025.

Fundraising Capabilities

Cumulative funds under management

1.2 trillion yen

Current funds under management

4,584 billion yen

External capital commitments(the amount subject to fund management fees)

1,985 billion yen

Size of most recent fund (domestic)

97.8 billion yen

Ratio of venture investment to buyout investment

2:1

Cumlutive number of fund investors

1,300 about

*As of March 31, 2025.

Organizational Foundation

JAFCO's investment track record

52 years

Number of employees (domestic)

162

Personnel enhancement in FY March 2025 (domestic)

20

Of which, New graduate

5

Investment professionals (domestic)

65

Of which, Investment professionals with 10+ years of experience

22

*As of March 31, 2025.

Funds (Investment Limited Partnerships)

Track Record

Cumulative funds under management

¥1.2 trillion

Current funds under management (domestic)

¥4,584 billion

*As of the fiscal year ended March 31, 2025. *Figures are based on total capital commitments including funds of overseas subsidiaries.

Composition of Limited Partners in Funds Under Management

SV4

Total commitments to SV4 Series

billion

(40.0 billion)(40.0 billion) Est. 2013.06

* The figure in parentheses is the amount for domestic investment.

institutions

firms

SV5

Total commitments to SV4 Series

billion

(50.0 billion)(50.0 billion) Est. 2016.06

* The figure in parentheses is the amount for domestic investment.

institutions

firms

SV6

Total commitments to SV4 Series

billion

Est. 2019.06

SV6 is limited to domestic investment only.

institutions

firms

etc.

SV7

Total commitments to SV4 Series

billion

Est. 2022.06

* SV7 is limited to domestic investment only.

institutions

firms

investment trusts,

etc.

* Most recent capital commitment basis; figures in ( ) show amount for domestic investment

More about our fund managmeent business

Fund Management

Our History

Here is our story of investing through both good times and bad and expanding the market, commitments we have held since the early days of venture and buyout investment in Japan.

Our History

About JAFCO

IR Library

Financial Information

Shareholder Information

Governance

Analyst Report

Report by Shared Research Inc.