Fund Management

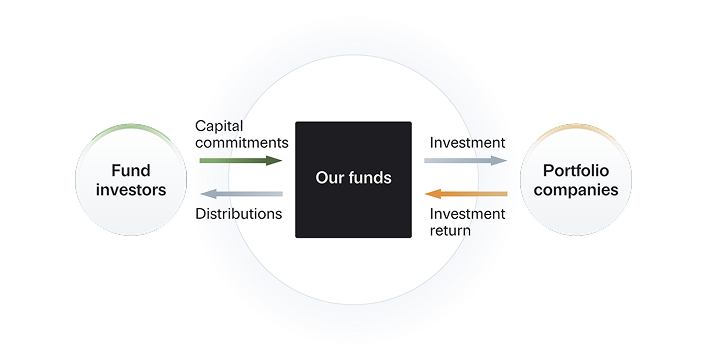

We raise capital from investors to form funds and use the capital to make venture and buyout investments.

JAFCO's Funds: Supporting Risk Capital in Japan

In 1982, we established the first venture capital fund in Japan

JAFCO No. 1 Investment Enterprise Partnership, the first venture capital fund in Japan, was established in 1982. At a time when venture capital was virtually unknown in the country, we pioneered a system similar to the US limited partnership model for raising mid- to long-term funds to be invested as venture capital.

Over the past 40 years, amid repeated legal revisions and economic fluctuations, we have continued to refine our fund management practices, supported by capital from institutional investors and business firms both in Japan and overseas.

Our goal is for our funds to be a continuous source of positive momentum for Japan's risk capital supply, fulfilling the hopes and trust of our investors.

About Our Funds

We raise capital from investors to form funds (investment limited partnerships) and use the capital to make investments.

After a fund is established, it invests in multiple unlisted companies over a period of three to four years. Within the fund's operating period (usually 10 years), these investments are sold or liquidated through listings or M&A. Investors are provided with returns while JAFCO recieves fees for managing the funds (fund management fees as well as success fees).

Through the diversification of risks of private equity investment through fund management, we can fullfill our goal to deliver consistently strong performance.

Track Record

Cumulative funds under management

¥1.2 trillon

Current funds under management (domestic)

¥4,584 billion

*As of the fiscal year ended March 2025.

*Both figures are based on total capital commitments including for funds managed by overseas subsidiaries.

Funds Under Management

SV4 Fund

Total amount

for fund series

¥60

billion

Established 2013

Fund Term 2026 (under extension)

Portfolio Composition

Domestic venture

Domestic buyout

Asian fund *1

US fund *1

SV5 Fund

Total amount

for fund series

¥75

billion

Established 2016

Fund Term 2026

Portfolio Composition

Domestic venture

Domestic buyout

Asian fund *1

US fund *1

SV6 Fund

Total amount

for fund series

¥80

billion

Established 2019

Fund Term 2029

Portfolio Composition

Domestic venture

Domestic buyout

*1: Investment in funds managed by our overseas subsidiaries.

SV7 Fund

Total amount

for fund series

¥97.8

billion

Established 2022

Fund Term 2032

Fund Series Composition *2

V7 ¥65.0 billion

Domestic venture

BO7 ¥32.8 billion

Domestic buyout

Composition of

Limited Partners

*2: The SV7 Fund Series consists of three types of funds: V7 (venture investment fund), BO7 (buyout investment fund), and SV7 (funds investing in both). The amounts indicated for V7 and BO7 include allocated portions from SV7.

Principles and

Transparency in Fund

Management

The mission of a fund manager is to maximize the interests of the fund, and by extension, its investors. With fiduciary duty as our highest priority, JAFCO has for many years upheld the following principles.

Investors decide to invest in a fund based on their trust in the fund manager.

Even after investing, information about portfolio companies, which influences performance, is highly confidential and difficult to obtain from the general public.

Given these characteristics of private equity investment funds, we believe that transparency in information disclosure to investors is essential.

We will limit our operations to the management of flagship funds for venture investment and buyout investment

To ensure we can devote maximum resources to managing our flagship funds, we have established three key policies that we strictly adhere to.

We do not establish

industry-specific funds

We do not establish

investor-specific funds

We limit our business

to fund management

Management of our own capital will be conducted through investment in our flagship funds, and we will refrain in principle from direct investment in portfolio companies

In order to avoid conflicts of interest between funds, new funds will begin investing only after existing funds have completed their new investments