Buyout Investment

Embracing a "Co-Founder" identity, we are deeply commited to supporting companies as they embark on the challenge of making a second start. By building systems that prioritize sustainable improvement of corporate value over short-term gains, we foster growth across both society and the economy.

Since the early days of Japan's private equity market, we have cultivated a consistently repeatable investment style, supporting the growth of our portfolio companies by expanding their buisnesses.

Invesments to date

67

IPOs

11

Cumulative investment amount

¥187.7 billion

*The above figures are cumulative totals for buyout investments from the establishment of the Structured Investment Division in 1998 through December 24, 2025.

Characteristics of Our Buyout Investmnet

At every one of our portfolio companies, we promote corporate

value enhancement through a growth-oriented approach rooted in

venture capital principles. We are fully committed as a team

member of each portfolio company to driving profit growth.

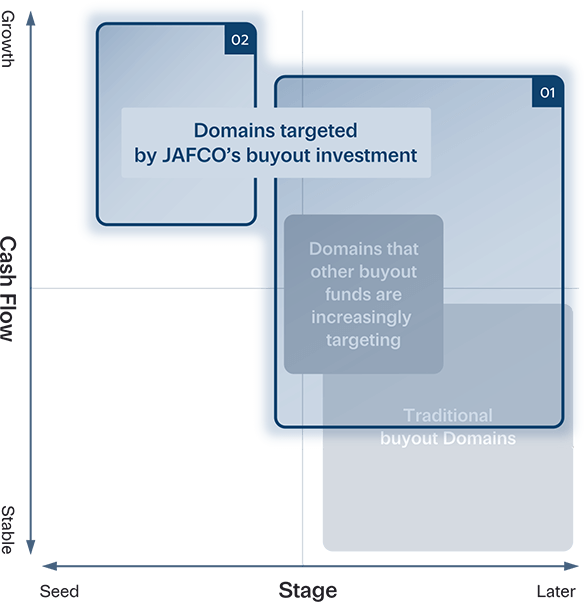

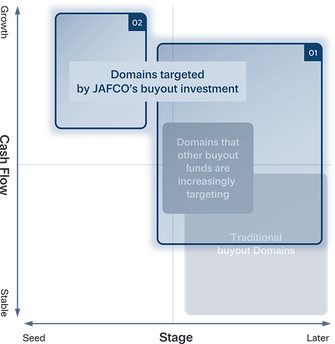

Targets of Our Buyout Investment

01

Primary Targets

-

Traditional buyout investment such as business succession and group restructuring of small and mid-sized companies

-

There are also cases where we aim for growth together with owners/CEOs who have sold their business and then reinvested in a portion of said business

02

Venture Buyouts—A Unique Investment Domain of JAFCO

-

We acquire a majority stake in early-stage startups and aim for rapid growth as part of their management team

-

By leveraging the expertise we've developed through venture investment, we pursue optimal value enhancement

Our dedication is demonstrated by our staff residing part-time at portfolio companies for periods ranging from six months to a few year. With our unique post-merger integration (PMI) approach which we cultivated through venture investment, we consistently offer fresh perspectives and ideas focused on growth, leading to enhanced corporate value.

Approach using the unique know-how and experience of JAFCO,

which was founded on venture investment

-

Management Strategy

-

Marketing

-

Finance

-

Operations

-

Administration

-

Branding

Execute High-Expertise Value Enhancement

-

Actively step in to promote sales channel development, joint development of products and services, M&A and business alliances, and global expansion for portfolio companies, going beyond simply providing management enhancement know-how

-

Collaborate with team specializing in corporate value enhancement support (Business Development Division)

Fully Utilize JAFCO's

Own Networks

-

Providing sales channel expansion and sales boosting measures by utilizing our extensive network of portfolio companies and investors cultivated through more than 50 years of investment activities

-

Promote marketing and streamlining of internal operations by introducing the latest SaaS products and other cutting-edge solutions developed by portfolio companies

We have a highly specialized business development team that works alongside our investment professionals. In order to accelerate the growth of our portfolio companies, we actively engage in key areas and aim for shared success.

Business Development Track Record

Number of contacts with business firms

5,000+

*Number of JAFCO's unique contacts calculated from our in-house CRM tool, Salesforce, as of March 31, 2025.

Number of companies supported in

organizational and recruitment matters

126

*Number of JAFCO's portfolio companies supported in solving the issues about Organization and Human Resource from April 2018 to March 2025.

Number of companies supported in back-

office structuring and IPO preparation

70

*Number of JAFCO's portfolio companies supported in solving BO structuring and IPO preparation issues from January 2020 to March 2025.

More about business development

Business Development

Case Studies

KOMINE Co., LTD.

-

Established

-

1947

-

Line of business

-

Design, manufacture, and sale of KOMINE brand motorcycle gear and apparel

Initial investment

2017

JAFCO proposed the establishment of a new management structure and business growth support to shareholders of KOMINE, a company with over 70 years of history, who were exploring succession options. Working together with the new management team, we implemented a business restructuring for a manufacturer known for its high functionality, safety, low cost, and industry recognition, while also rebuilding the foundation to support future growth through e-commerce, overseas sales, and investment in new business ventures.

Post-investment growth support

Strategy

Reorganized management system supporting future growth and stability

- Inherited know-how from the two owners

- Appointed experienced employees to executive positions in stages

- Hired management and financial officers

Operation/IT

Established quick delivery system supporting EC sales enhancement

- Consolidated and relocated four domestic warehouses, eliminating inter-site transportation and enabling immediate delivery

- Implemented warehouse management system

Sales & Marketing

Strengthened EC channels and overseas expansion to expand sales

- Switched to direct wholesale to major e-commerce platform and launched the company’s own EC site for strategic CRM

- Participated in overseas trade shows and secured distributors in new regions

Finance/Accounting

Enhanced financial/accounting management system

- Streamlined management and financial accounting

- Accelerated the closing of financial statements

BizDev

Established business in adjacent field in view of obtaining future users

- Developed new products for kids' sports (Strider) for obtaining future potential customers

Outcome

- Transitioned smoothly from owner's system of one-man management to new team management

- Achieved revenue growth (2017–2019: CAGR +7.1%) while maintaining low-cost operations that support high profitability

Nagano Industry Co., Ltd.

-

Established

-

1968

-

Line of business

-

Manufacture and sale of aerial work platforms

Initial investment

2018

The theme with Nagano Industry, a top domestic player in a niche market which boasts high profitability and technological strength, has been overseas market development with the goal of driving long-term growth. After strengthening the management structure in preparation for overseas expansion, we helped the company enhance its product development and overseas sales/marketing efforts. We also helped it expand its product lineup and implement improvements to financial/accounting management and supply chain operations.

Post-investment growth support

Strategy

Strengthened management system looking towards overseas expansion

- Appointed former executive from one of largest construction equipment manufacturer as new president

- JAFCO's managing director (executive in charge of administration) also participated

Sales & Marketing

Strengthened domestic sales and transitioned business model to expand overseas

- Significantly increased domestic sales staff and promoted diversification of distribution channels incl. purchasing used equipment

- Established European sales subsidiary, developed overseas distributors, and actively participated in international trade shows

BizDev

Enhanced product development capabilities and lineup

- Established product development system to explore high-value-adding and new segments

- Strengthened coordination between manufacturing and sales to shorten product development lead time

Finance/Accounting

Strengthened financial/accounting management system

- Implemented cost-of-production accounting and strengthened budget vs. actuals management system

- Visualized inventory management and revised material ordering rules

Operation/IT

Established supply chain to support high operation and sales

- Improved productivity by eliminating bottleneck processes (strengthening procurement from China)

- Strengthened production capacity by expanding factory layout and extending assembly processes

PR/HR

Actively increased PR awareness

- Revamped company website and strengthened participation in domestic trade shows

- Promoted recruitment of top talent through U-turn and I-turn hiring

Outcome

- Overcame market chaos during the pandemic and changes in the environment with rise in material costs to achieve record sales (2018ー2023: CAGR+9.0%)

- Successfully expanded not only into the EU but also into East Asian markets such as South Korea, Taiwan, and Singapore

Progress Technologies Group, Inc.

-

Established

-

2005

-

Line of business

-

Provider of one-stop services including consulting, solutions, projects, and engineering specializing in design and development.

Initial investment

2020

IPO

Mar. 28, 2025

After JAFCO’s investment, Progress Technologies Group, under a new management structure, drove a business shift from engineer staffing to high-value-added solution areas and successfully achieved an IPO. We supported the company throughout its journey from business growth and performance expansion to listing, focusing on strengthening its governance framework and expanding upstream consulting and solution offerings for the manufacturing sector, leveraging its core technologies and expertise.

Post-investment growth support

Strategy

Shifted to high-value-added solution business area

- Exploration of higher value-added business areas under new management structure

- Transition to a digital transformation consulting and solutions business for manufacturers' design and development departments

Sales & Marketing

Enhanced marketing by utilizing JAFCO's own network

- Held webinars for business firms (co-hosted with JAFCO)

- Introduced potential sales prospects

Strategy

Strengthend management and governance system in view of listing

- Planned audit & supervisory committee and established IPO framework

- Introduced holding company structure and adopted IFRS

BizDev

Started new business

- Established new business (digital twin business) using knowhow from existing business

Outcome

- Realized steady growth of top-line revenue and improved profitability

- Established corporate governance system as a public company

Contact Us

Feel free to contact us if you are a business owner thinking about restructuring or succession, or know somebody who is.

Contact Form