Funds

Large Pool of Investment Capital

As of the end of March 2025, JAFCO had established over 100 investment funds with total commitments of ¥1 trillion.

There are about 1,200 investors in our funds, including financial institutions, pension funds, and business corporations. This is a testament to the trust JAFCO has built over the last 40 years in the private equity industry.

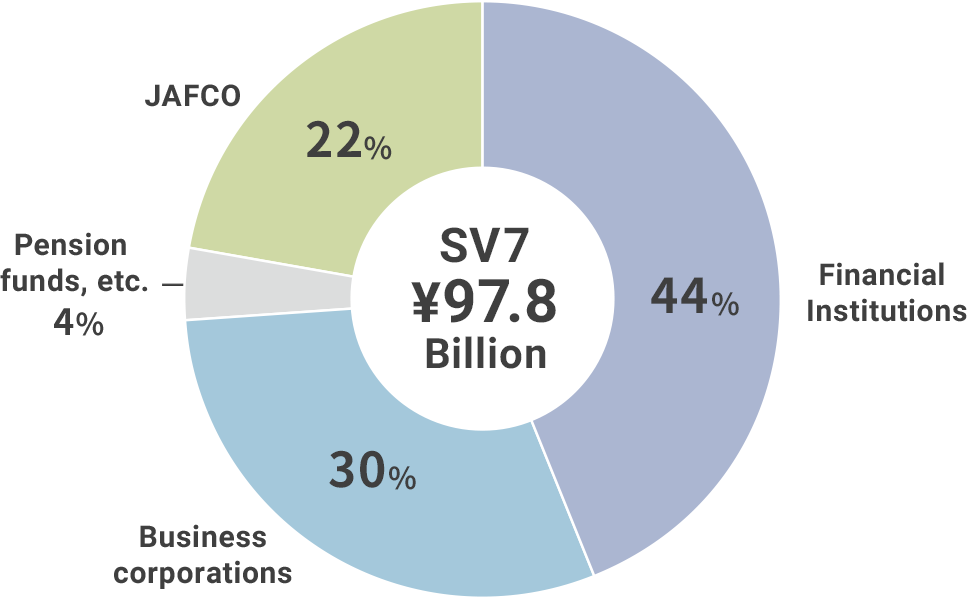

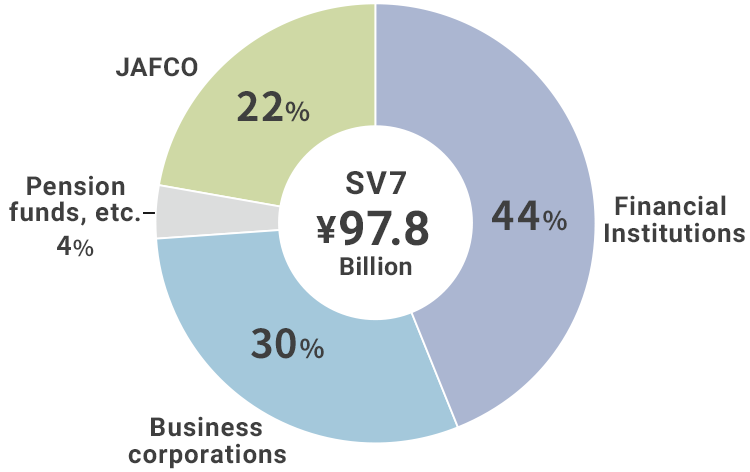

JAFCO SV7 Series (est.2022) Investor Composition

Three Management Policies

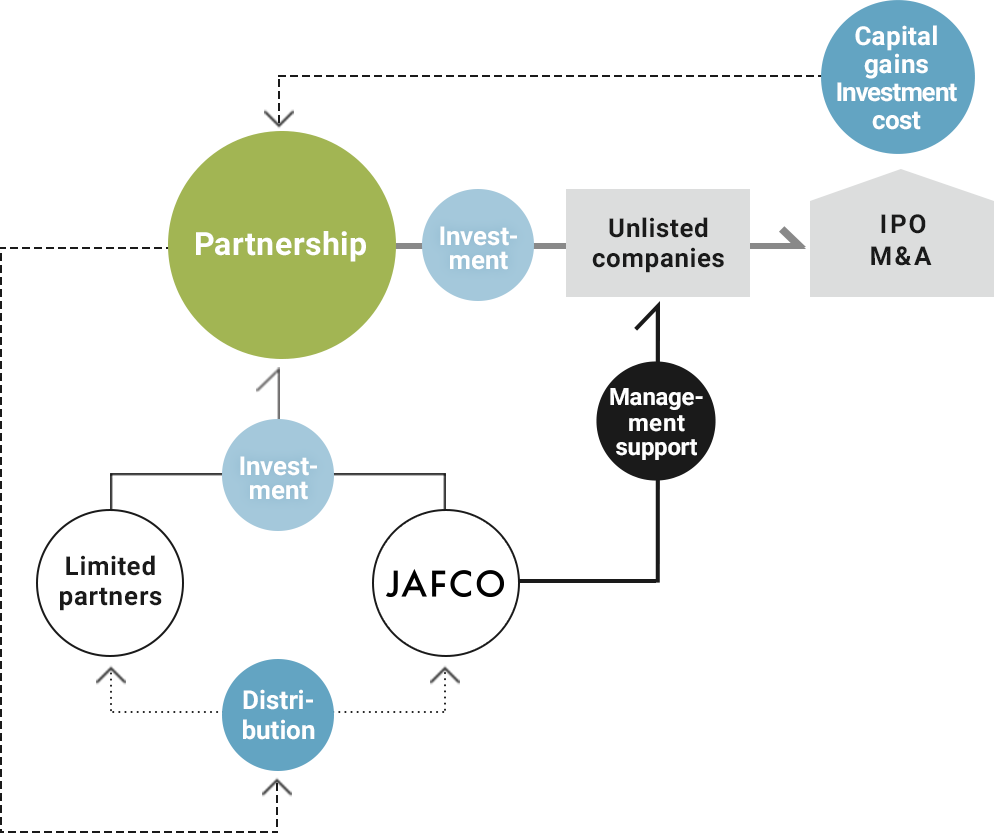

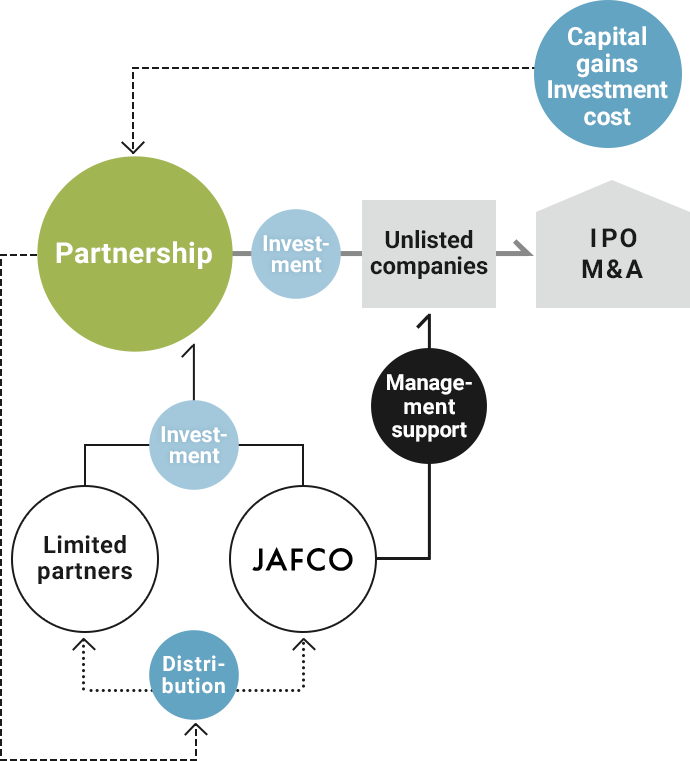

We raise capital for funds from institutional investors and business firms about once every three years, and we invest a certain amount of our own capital in the funds alongside investors. Partners and employees also invest in funds as individual investors. As Japan's pioneer in venture capital fund management, we will preserve discipline and transparency under the following three management policies.

We do not establish industry-specific funds

We do not establish investor-specific funds

We only conduct fund management

Investment Through Funds

JAFCO makes investments through investment limited partnerships (funds).

Main Funds Making New Investments

| Establishment | Name of fund | Investment target | Total commitment amount |

|---|---|---|---|

| Jun. 2022 | JAFCO SV7 Series | Private equity investment in domestic companies with high growth potential | ¥97.8 Billion |

| Apr. 2021 | JAFCO Asia S-8 Fund Series | Private equity investment mainly in China, India, and Southeast Asia | US$ 130 Million |

| Jan. 2021 | Icon Ventures Ⅶ, L.P. | Private equity investment mainly in the US | US$ 235 Million |

- Note:

- "Total commitment amount" is the total amount committed by partners under the terms of the partnership agreements.

Funds under Management

| 2024.03 | 2025.03 | |

|---|---|---|

| No. of funds | 26 | 25 |

| Total commitment amount

(JAFCO's share) |

¥465.5 billion (35.6%) |

¥458.4 billion (34.5%) |

- Note:

- "Total commitment amount" is the total amount committed by partners under the terms of the partnership agreements.

US dollar-denominated commitments have been converted into yen at the exchange rate as of the end of each consolidated fiscal year.

To Fund Investors

Please click below to receive fund management reports, etc. through e-shishobako (an online mailbox system).