Based on our purpose "Fueling perpetual growth; investing in bold visions" and our mission "Commit ourselves to new business creation and jointly shape the future,"we identify new technologies and services that should be indispensable and work with entrepreneurs to commercialize them to realize a better society.

This activity strongly matches with the concept of sustainable investment. Many start-up companies are established with a motive to solve social issues and contribute to the society. By supporting their growth through investment activity, we contribute to the emergence of companies that will cause large social impacts in the future.

The Basic Policy on Sustainability

We established the basic policy on sustainability for the purpose of sharing our philosophy regarding sustainability as well as our ESG issues and response policies with our stakeholders, and ultimately realizing a sustainable environment and society.

Sustainable investment activity

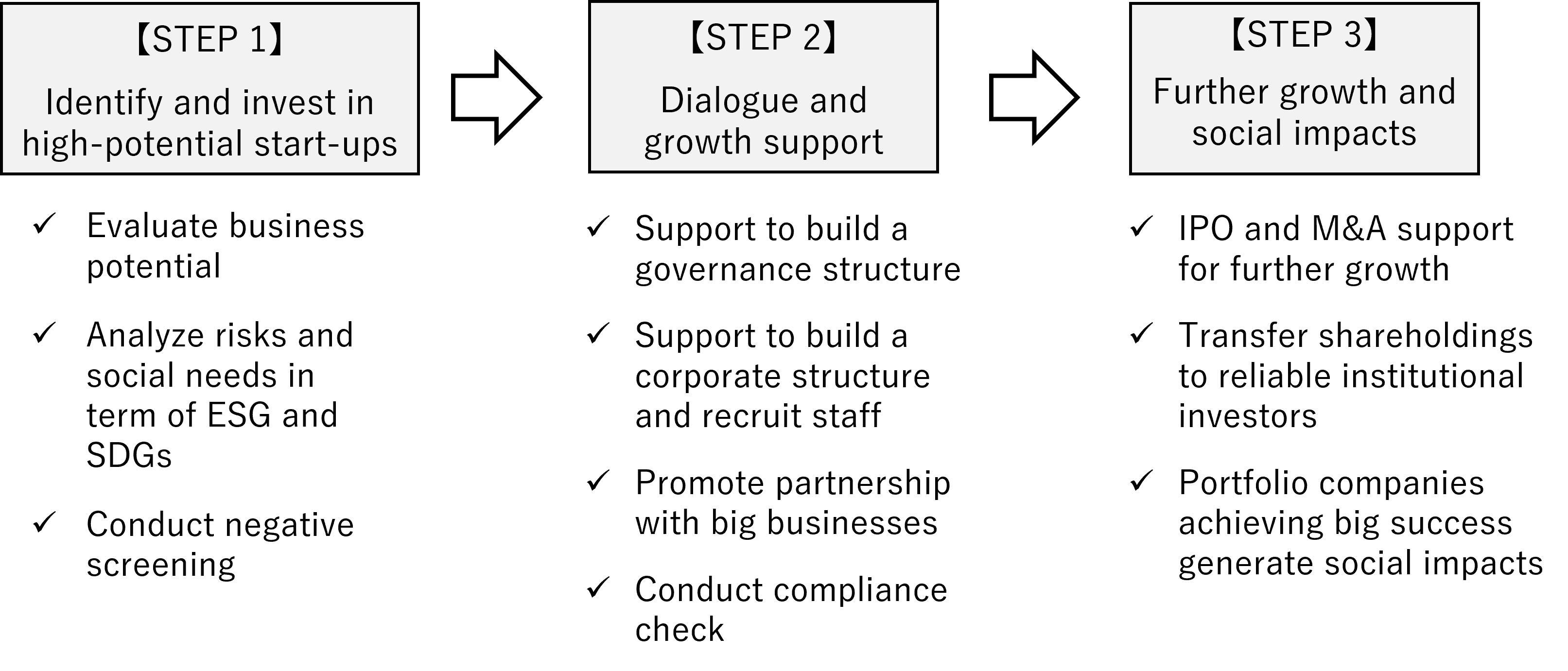

Many start-up companies are established with a motive to solve social issues and contribute to the society. By providing hands-on support and working together with founding CEOs of start-up companies, we contribute to the emergence of companies that will generate large social impacts in the future. We incorporate ESG concept into our investment activity and provide in-depth discussions and concrete support beyond the framework of engagement with portfolio companies.

Our approach during investment phase

Evaluation of business potential and social needs

- Many start-up investment candidates have intrinsic value, such as excellent business ideas, strong CEOs, etc., but often lack resources, internal controls, etc. Based on a premise of addressing such issues with CEOs after investment, we make bold investments in start-ups with a focus on business potential, social needs and other positive aspects.

Negative screening and Investment consideration in terms of ESG and SDGs

- In the process of identifying investment candidates and due diligence, we check candidates' compliance management status, relationships with customers and employees, and administrative structure. We also conduct analysis in terms of links between candidates' businesses and 17 SDGs goal.

- If negative factors are found during the due diligence process in light of ESG, SDGs and social norms, we pass on investment on relevant deals in accordance with our investment discipline.

Our approach during post-investment, growth support phase

Support for building governance structure

- The importance of governance continues to grow as seed/ early-stage start-up companies have increased to account for majority of our portfolio companies. To raise the social status of the portfolio companies, it is necessary to build corporate/ administrative structures according to their growth stage.

- To allow start-up companies to implement sales management and proper money management with limited human resources, we provide various cloud service installation support and suggestions on designing internal controls.

Support for HR recruitment and building corporate structure

- Formation of a management team consisting of competent CxOs is vital for start-ups' business expansion. Since obtaining a license for free employment placement business in 2018, we have been offering proactive recruitment support for portfolio companies. During the business expansion phase, we also support the companies in building a corporate structure by establishing an organizational chart, company regulations, and decision-making authority.

Promotion of partnerships with large companies

- We have long been leveraging our network of limited partners and other large companies to boost growth of our portfolio companies. Collaboration between big businesses and start-ups has become increasingly active due also to the government-backed promotion of open innovation.

- We hold seminars and participate in new business development programs to give back our venture capital know-how proactively to large companies. By offering our expertise in VC evaluation method, investment conditions, capital policy, etc., we contribute to shaping an eco-system that allows venture capital firms, big companies and start-up companies to complement each other.

Implementation of compliance check

- We conduct compliance check of our portfolio companies periodically, including checking for legal violations, acquisition of necessary license for business activity, and the status of cash management. Through such measures, we work to reduce compliance risks of portfolio companies.

Growth acceleration through IPO and M&A, and social impacts

- For a portfolio company to realize its founding vision and generate social impacts, it is necessary to create a business base that allows smooth growth after our exit from the company. We are constantly discussing with management teams of portfolio companies about the future path of their companies beyond IPO or M&A. Upon IPO, we will sell our shareholdings in a manner that would have a minimum effect on stock price, or transfer the shares to high-performing institutional investors that are expected to support the companies as a stable shareholder.

- We have invested in over 4,000 unlisted companies to date and supported their growth. Among these include companies whose business activities align with SDGs, or which have become big names in Japan following an IPO and are proactively addressing SDGs to fulfill their social responsibilities. We will continue with our contribution to the achievement of SDGs through our investment activity.

HR strategy

For our business, human resources are the key to remain competitive. In the midst of drastic changes in the environment surrounding start-up companies, we position hiring and nurturing diverse, high-potential talents an important management issue.

Development of individual ability and personnel diversification

- Efficient ways of using time to produce results, including closely examining business potential, addressing various issues facing portfolio companies, etc., differ from one member to another. For this reason, we have introduced complete flextime since March 2017 to allow each member to choose their working hours depending on their work and physical conditions. Also, we promote remote workstyle by providing office-like environment through cloud/ mobile IT systems to allow members to work from anywhere.

- We have created an environment where members can improve work efficiency and reduce idle hours at work, so that they can better manage their health and adapt to changes in family circumstances, and use their free time for self-development and external activities. We are also promoting a two-week vacation to inspire out-of-the-box thinking.

- While supporting various working styles, we encourage our members to do side businesses to enhance their professionalism.

- For personnel development, we had been focusing on new graduate recruitment and OJT career development. In recent years, our role desired by portfolio start-up companies has diversified and more specialized expertise has become necessary. For this reason, we have started to promote personnel diversification through aggressive midcareer recruitment from other industries and the use of external specialists. With regard to new graduate recruitment, we have adopted a long-term internship program to determine their aptitude carefully.

Health Management

- In March 2024, JAFCO was recognized in the 2024 Certified Health & Productivity Management Outstanding Organizations Recognition Program (Small and Medium-Sized Enterprise Category) hosted by the Ministry of Economy, Trade and Industry and Nippon Kenko Kaigi.

- Physical and mental well-being form the foundation for each of our employees to harness their full potential and fulfill our Purpose/Mission. We are committed to ongoing health management that maintains and improves the physical and mental well-being of our employees.

In July 2022 we made a Health Declaration to the National Federation of Health Insurance Societies, leading to our achievement of an Excellent Health Company Silver Certification in April 2023. This recognition underscores our ongoing commitment to health management and promotion initiatives.

Governance

In order to continue investing under any circumstances, we need to live up to the expectations of our various stakeholders, including shareholders, fund investors, portfolio companies and employees. A well-balanced governance is vital to realize a virtuous cycle consisting of growth of portfolio companies, improvement in fund performance, and shareholder interests. We wish to serve as an excellent governance model for our portfolio companies aiming to make IPO.

Composition/ operation of the Board of Directors and business execution structure

- The Company is a company with Board-Audit Committee and, in principle, independent directors comprise a majority of the Board of Directors. Currently, four out of six directors are Board-Audit Committee members, all of whom are independent directors. Independent directors supervise the business execution of directors, etc. from an independent and objective perspective.

- Election, dismissal and remuneration of directors are determined by the Board of Directors after deliberations by the Nomination and Remuneration Committee composed of all Board-Audit Committee members and the President.

- The Company has introduced the corporate officer system to strengthen and accelerate business execution.

- The Company proactively selects suitable executive candidates from diverse background regardless of gender and nationality. Currently, one of the six directors and one of the two corporate officers are women.

- ※

- Refer below for basic views on corporate governance, corporate governance structure, etc.

Management of conflict of interest in fund management

- We will preserve discipline and transparency under the following three management policies.

- We will not establish industry-specific funds

- We will not establish investor-specific funds

- We will not engage in any business other than PE investment and fund management

- In principle, we do not make direct investments using our own capital. We invest our own capital in funds that we manage as General Partner, thereby making indirect investments as part of fundsʼ assets under management.

- In principle, there are no transactions between JAFCO and its funds, or between JAFCO funds.